| home > 2010 financial > consolidated > review of consolidated balance sheet, income statement and financial position |

home > 2010 financial > consolidated > review of consolidated balance sheet, income statement and financial position

review of consolidated balance sheet, income statement and financial position

Income Statement

The Rai Group income statement for 2010 shows a net loss of 98.2 million euros, against a loss of 61.8 million euros for

2009. The difference with the result of the Parent Company result, which presents a net loss of 128.5 million euros, is largely

determined by the elimination of the dividends disbursed by the Group companies in relation to the previous year's results

against those for the year ending.

The following section provides an overview of the main items of the Income Statement and the reasons behind the more significant

changes from the previous year.

Revenues from sales and services

Revenues from sales and services consist of licence fees, advertising revenues and other commercial revenues.

They totalled 3,012.1 million euros, down 165.7 million euros (-5.2%) on 2009.

A breakdown of revenues from sales and services, per company and net of operations between Group companies, is presented in the following table.

Licence fees (1,685.4 million euros). These include licence fees for the current year as well as those for previous years, collected

through coercive payment following legal registration.

They also include accounts receivable from the Ministry of the Economy and Finance for unpaid licence fees relating to 2008,

2009 and 2010 for subscribers exempted from payment, pursuant to art. 1 paragraph 132, law no.244 of 24 December

2007. It should be pointed out that circular 46/E, dated 20 September 2010, in defining the subjective requirements and

the procedure that the parties concerned have to observe to take advantage of such benefit, the Inland Revenue Department

established the necessary basis for identifying those entitled to exemption. The identification of exempted subscribers, which is

now in the advanced stages, has made it possible to prudentially estimate an account receivable of 2.0 million euros.

The overall increase (+2.4%) refers to the increase in the per-unit licence fee from 107.50 euros to 109.00 euros (+1.4%),

and to the marked increase in measures to coerce payment. There has also been an increase in the number of paying subscribers

(+0.2%) and the recovery of new subscribers (+3.4%), following a decline in 2009.

Advertising revenues. As soon as the first timid signs of recovery from recession began to appear, the national advertising

market showed a reversal of the trend for 2009, and presented moderate but widespread signs of recovery for almost every

medium and sector: the advertising market presents growth of 3.8% in 2010, increasing revenue by about 300 million euros.

With the exception of Periodicals and Daily Newspapers, all media have shown a positive trend. The Rai Group reference

market (TV, Radio, Cinema and Internet) showed an overall increase of 7.0% (source Nielsen) in 2010.

In this context, the Rai Group's advertising revenues (1,028.9 million euros) highlight an increase of 40.4 million euros

(+4.1%) compared with 2009.

The growth of the specialised channels should be noted, as they recorded a considerable increase in viewers compared with

2009, due to the high quality of programming, the expansion of the DTT signal broadcasting area and actions for the repositioning

and rebranding of certain channels (Rai Movie and Rai 5).

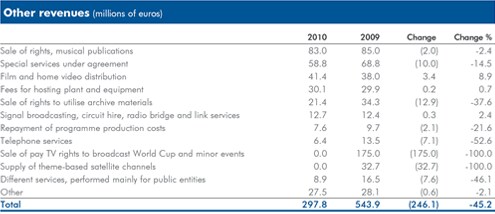

Other revenues show a decline of 246.1 million euros (-45.2%). This was mainly determined by the absence of the income

booked in 2009 for the sale to third parties of the pay TV broadcasting rights for the 2010 and 2014 World Cups and for

other minor FIFA events, for 175 million euros.

Other reductions of the caption are highlighted in the table below.

They comprise the zeroing of income from the Supply of theme-based satellite channels by former RaiSat (-32.7 million euros),

the reduction of the Sale of rights to the utilise archive materials (-12.9 million euros) for the different effects of the agreements

entered into during the two years, Special services under agreement (-10.0 million euros) as a consequence of the reorganisation

of activities envisaged under the foreign broadcasting agreement, Services rendered to telephone companies (-7.1 million

euros) and Different services, performed mainly for public entities (-7.6 million euros) including lower income from the Ministry

of Education, University and Research (5.5 million euros in 2009).

A breakdown of other revenues, per company and net of operations between Group companies, is presented in the following table.

As shown in the table below, the relative weights of the three components on total revenues from sales and services show an increase in the Licence fees and Advertising items compared with the totals for the previous year, to the detriment of the Other revenues component.

Operating costs

These total 2,398.2 million euros, falling 142.0 million euros compared with 2009, equating to 5.6%, the reasons for which

are listed below.

The caption includes internal costs (labour cost) and external costs, regarding ordinary business activities, according to the

following classification.

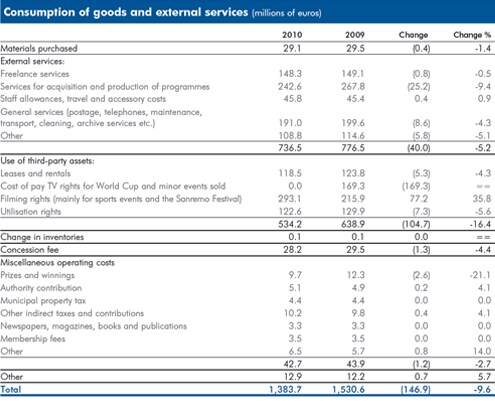

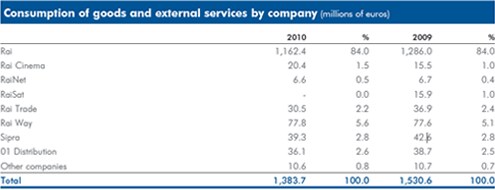

Consumption of goods and external services - This caption includes purchases of goods and services required to make

programmes of immediate-use (purchases of consumables, external services, artistic collaborations, etc.), filming rights for

sports events, copyright, running costs (rental and hire fees, telephone and postage, cleaning, maintenance, etc.) and other

operating costs (direct and indirect taxes, contribution to the Authority, the public broadcasting concession fee, etc.).

As shown in the table, the caption shows a drop of 146.9 million euros (-9.6%), determined by the absence of the cost of pay

TV broadcasting rights for the 2010 and 2014 World Cups and for other minor FIFA events, for 169.3 million euros, subject

to the sale to third parties booked last year and mentioned earlier.

The comparison, net of this component, highlights an increase in the caption of 22.4 million euros (+1.6%), largely deriving

from the increase in costs to purchase broadcasting rights mainly for sports events (+77.2 million euros). As in all even

numbered years, 2010 was characterised by important four-yearly sports events (World Cup and Winter Olympics) influencing

the 2010 income statement by 107.8 million euros, partially offset by savings from the broadcasting rights for the Champions

League and Italian National Football Team matches.

In addition to the above, savings were made in the other components of the caption, confirming last year's trend.

A breakdown by individual Group company of the cost of goods and services, net of transactions between Group companies,

is given in the following table:

Personnel costs - These amount to 1,014.5 million euros, up by a total of 4.9 million euros on the total at 31 December 2009 (+0.5%), as detailed in the table below.

The previous year's trend of personnel cost containment was confirmed, remaining well below the rate of inflation, thanks

partially to the absence of provision (for all Group companies apart from Sipra) for middle management, office staff, blue

collar and executive bonuses, resulting in a lower cost of about 17.5 million euros.

The reduction in personnel costs is also due to a series of management measures to offset the economic impact of automatic

pay increases provided for by the labour contract, the stabilisation of those on temporary employment contracts, the rise in the

staff severance pay revaluation index and, above all, the simultaneous renewal of all the collective contracts.

Among the actions taken, incentives for resignation and the substantial blockage of management policies played a significant

role.

A breakdown of personnel costs by individual Group company is given in the following table.

Personnel on payroll at 31 December 2010 (including 63 work-introduction and apprenticeship contracts) amounted to

11,402, up 15 on the same date of the previous year. In detail, Group company leavers numbered 439, of whom 279 left

under resignation incentives, while engagements numbered 454, 366 of which following the signing of permanent employment

contracts by temporary workers in application of trade union agreements, 33 returns to work following legal action and

5 compulsory placements. Amortisation and depreciation charged for the year amounts to 121.9 million euros, with a drop of 0.7 million euros compared

with 2009, referring entirely to tangible non-current assets, in relation to the progressive completion of the depreciation

of assets acquired in the past. Other net income (charges) Operating result Net financial expense Financial operations show a drop in net interest payable to banks of 0.3 million euros, due to the rise in financial exposure to

third parties, partly offset by the drop in market rates.

The average number of employees, including those on fixed-term contracts, came to 13,295, down 57 from the previous

year due to an increase of 114 in the number of staff on permanent contracts and reduction of 171 in the number of staff on

fixed-term contracts.

Gross Operating Margin

The Gross Operating Margin, as a consequence of the above, is positive by 641.7 million euros, down 26.1 million euros,

or 3.9%, on the previous year.

Amortisation of programmes

This caption is related to investments in programmes which, during 2010, amounted to 509.8 million euros, down 33.2

million euros (-6.1%), regarding every kind of programme, as highlighted in the following table.

A breakdown of investments in programmes by each individual company is shown in the following table:

Amortisation charged to the above captions for the year, 507.0 million euros, shows a reduction of 21.4 million euros

(-4.0%) compared with the previous year, related to the performance of investments.

Other amortisation and depreciation

The 2010 movement in this caption, shown in the following table, is linked to investments in tangible non-current assets

and other investments, and presents a total reduction of 2.9 million euros (-1.9%). This is determined by growth in

investments in tangible assets (+4.2 million euros) made principally by Rai Way for the development of the digital terrestrial

broadcasting service and a reduction in other investments (-7.1 million euros).

The table below shows the breakdown by company and type:

The caption comprises costs/revenues not directly related to the Company's core business and, in 2010, highlights net expenses

of 32.2 million euros (51.7 million euros in the previous year). In detail, the caption comprises expenses relating to

repeat-usage programmes which it is not expected will be used, repeated or commercially exploited (42.8 million euros),

provisions for risks and charges (19.1 million euros), provision to the credit depreciation fund (8.4 million euros), provision to

the supplementary pension fund for former employees (9.7 million euros), partly offset by net prior-year income (29.2 million

euros) and releases of funds allocated in previous years (20.0 million euros).

The results described above for operating revenues and costs led to an improvement in the operating result, from -34.9 million

euros in the previous year to -19.4 million euros this year, with a drop of 15.5 million euros.

Net financial expense shows a loss of 0.4 million euros, improving on 2009 (-4.8 million euros). The caption shows the

economic effects of typical financial operations and comprises bank interest expense and income as well as that relating to

Group companies and net income/expense in relation to exchange rates.

Exchange rate differences, deriving from the purchase of sports broadcasting rights (Rai) and investments in intangible assets

(Rai Cinema) in US dollars, are positive, thanks to hedges implemented in prior years, which limited the negative oscillations

in the exchange rate during the year.

The average cost of loans by banks and other financial institutions, consisting of current account credit lines, “hot cash” and

stand-by loans, has fallen due to the significant reduction in the money market reference rates, standing at 1.9% (2.3% in the

previous year).

Net exceptional expense

This caption amounts to 45.6 million euros (0.5 million euros in 2009) originated mainly by 45.4 million euros of expenses

for incentivised early staff resignation.

Income taxes

These amount to 33.8 million euros and represent the balance between current and deferred taxes as shown in the table.

IRES of 38.4 million euros presents an increase of 11.2 million euros on the previous year's figure, relating to the better economic

results of certain Group companies.

No amount was recorded for IRES for the Parent Company, as the year is expected to have a negative tax result.

IRAP for 35.6 million euros is stable on the previous year's figure.

Deferred tax liabilities in 2010 determine a positive effect equating to 2.6 million euros (13.8 million euros in 2009), as a

consequence of the reversal of the temporary differences in income deriving from higher amortisation applied in previous

years, purely for tax purposes.

Deferred tax assets (37.8 million euros) originated from the booking of IRES credit deriving from the negative taxable amount

for the year, which was related mainly to the Parent Company. This was offset by the positive taxable amounts of the subsidiaries,

included within the scope of consolidation for the 2010 tax year.

Balance Sheet aggregates

Non-current assets

Tangible non-current assets are detailed in the following table.

Investments in programmes are represented mainly by TV fiction series (490.1 million euros) and films (335.3 million euros).

Equity investments amount to 9.5 million euros and present a reduction on the previous year (3.8 million euros), largely due

to the closure of Sacis liquidation process.

Other non-current assets are shown in the following table:

Working capital

The change from 2009 (-101.2 million euros) is due mainly to normal developments in the business.

Major changes relate to:

• Trade receivables: down 123.8 million euros, mainly determined by the booking during the year of prior amounts receivable

for services rendered to the Government under contract.

• Other assets: down 39.2 million euros and largely related to the re-entry of advance payments made to purchase the

broadcasting rights for sports events held during the year (particularly the World Cup and Winter Olympics).

• Other liabilities: down 46.3 million euros, determined mainly by the different temporary liquidation of various accounts

payable.

Net financial position

The year-end net financial position is negative by 150.4 million euros, showing no significant changes compared to the

previous year (-151.5 million euros) and is comprised as follows:

Despite the negative economic result, the improvement in working capital, mainly due to the collection of prior accounts receivable

for services rendered to the Government under contract, and the reduction of the total investments made, contributed

significantly to the substantial stability of the net financial position compared with the previous year.

The average financial position is negative by about 188 million euros and has deteriorated compared to the previous year

(-144 million euros).

The analysis carried out on the basis of the balance sheet and income statement ratios highlighted that:

• the the net invested capital coverage ratio, calculated as the ratio between net invested capital and net equity, is 1.28 (1.24

in 2009);

• the current ratio, identified as the ratio between current assets (inventories, current assets, cash and cash equivalents and

financial receivables) and current liabilities (current liabilities and financial debts), is 0.73 (0.83 in 2009);

• the self-coverage ratio of non-current assets, calculated as the ratio of Shareholders' equity to non-current assets, is 0.33

(0.39 in 2009).

The financial risks to which the Group is exposed are monitored using appropriate computerised and statistical instruments.

A policy regulates financial management in accordance with best international practice, the aim being to preserve the corporate

value by taking an adverse attitude towards risk, pursued via active monitoring of the exposure and the centralised

implementation of suitable hedging strategies by the Parent Company, also acting on behalf of the subsidiaries.

In particular:

• The exchange risk is significant in relation to the exposure in US dollars generated by the acquisition of rights to sports

events in foreign currencies by Rai (as well as the funding of the foreign associated company Rai Corporation) and of film

and television broadcasting rights by Rai Cinema. These commitments generated payments for about 180 million dollars

during 2010. Operation takes place from the date of subscription to the commercial commitment, often lasting several

years, and aims to defend the counter value in euros of commitments estimated at the time of order or in the budget.

Hedging strategies are implemented using financial derivative instruments - such as forward purchases, swaps, and options

structures - without ever taking on an attitude of financial speculation. The group policy envisages numerous operating

limits to be observed by the hedging activity.

• The interest rate risk is also regulated by the company policy, particularly for medium/long-term exposure with specific

operating limits. At the moment, the financial position does not contain significant long-term and variable rate exposures,

but sees short periods of operational liquidity alternating with overdraft positions through reversible credit lines or stand-by

loans, for it was deemed unnecessary to activate hedging operations.

• The credit risk on cash deployment is limited in that the company policy envisages the use, for limited periods of cash

timing differences, of low-risk financial instruments with parties with high ratings. Only tied deposits or sight deposits with

remunerations close to the Euribor rate were used during 2010.

• As regards the liquidity risk, it should be noted that the Group has short-term credit lines with the banking system, which

are in excess of 475 million euros. A stand-by loan for 220 million euros has been taken out with a group of banks and is

due to expire in 2012. The total loans are sufficient to cover the overdrafts, although the procedure for liquidating the four

deferred instalments by the Ministry of the Economy and Finance can generate tensions in the event of significant delays

with respect to the quarter-end dates established by contract. To cope with the significant investments required by the DTT

project, besides having applied to the European Investment Bank for a medium/long-term loan, the company has also

begun a selection procedure with the banking system, which should be completed in the first half of 2011, to restructure

the sources of loans, with a view to extending them over a longer period of time.

|

|