| home > 2012 financial > consolidated > review of consolidated balance sheet, income statement and financial position |

home > 2012 financial > consolidated > review of consolidated balance sheet, income statement and financial position

review of consolidated balance sheet, income statement and financial position

Income Statement

The Income Statement of the Rai Group for financial year 2012 recorded a net loss of 244.6 million euros, against a net

profit of 4.1 million euros for financial year 2011, mainly determined by the strong and unexpected reduction of advertising

revenues (-219.5 million euros) and the costs of big sports events. The difference with the result of the Parent Company Rai SpA,

which presents a net loss of 245.7 million euros, is related to adjustments of intercompany transactions.

The following section provides an overview of the main items of the Income Statement and the reasons behind the more significant

changes from the previous year.

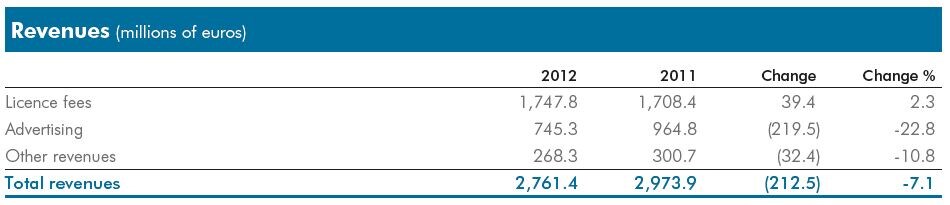

Revenues from sales and services

Revenues from sales and services consist of licence fees, advertising revenues and other commercial revenues.

They totalled 2,761.4 million euros, down 212.5 million euros (-7.1%) on 2011.

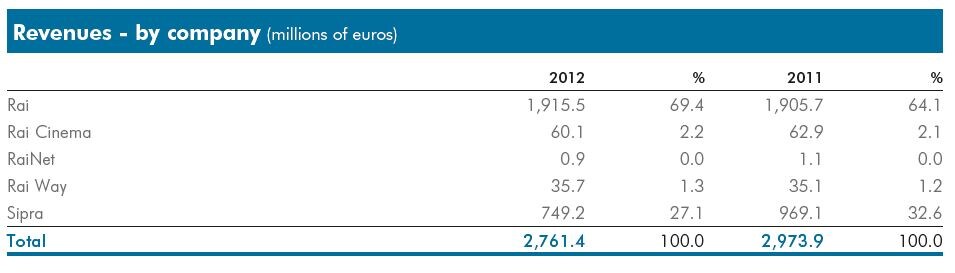

A breakdown of revenues from sales and services, per company and net of intra-group transactions, is presented in the following

table.

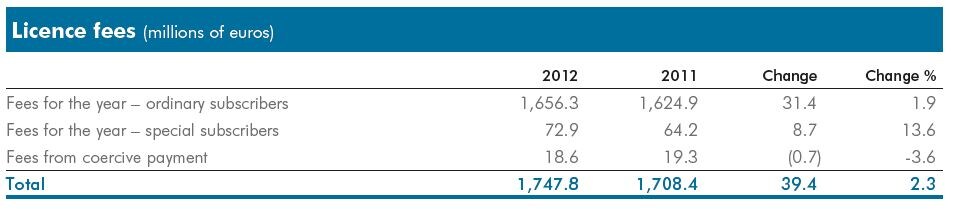

Licence fees(1,747.8 million euros). These include licence fees for the current year as well as those for previous years, collected

through coercive payment following legal registration.

The overall increase (+2.3%) refers to the increase in the per-unit licence fee from 110.50 euros to 112.00 euros (+1.4%)

and to the increase in the number of paying subscribers due to the significant growth in new subscribers compared to the

number of new subscribers in 2011 (506,486 units, +26.0%) capable of offsetting the rise in cancellations and arrears, or of

the number of subscribers entered in the list of debtors who have not paid their licence fee.

Advertising revenues.In a framework characterised by the deceleration of the economy and the drop in consumption,

advertising revenues in 2012 also recorded evident signs of difficulty. The Nielsen figure, while failing to allow a fully standardised

comparison due to the fact that changes have been made in the setting in which data is measured, show a 14.3%

contraction in the advertising, affecting all media, apart from the Internet, which closed at +5.3%. Television and radio advertising

investments in particular show a decline of 15.3% and 10.2% respectively.

In this context, the Rai Group’s advertising revenues (745.3 million euros) highlight a reduction of 219.5 million euros

(-22.8%) compared with 2011, as shown in the table below.

The drop in advertising revenues was higher than the contraction of the reference market, determining a considerable loss of

the market share by the Rai concession holder during the year. To offset this, incisive actions were taken to intervene on the

various corporate areas of Sipra, including a review of commercial practices and a strengthening of the managerial layout

and of in-house procedures.

It should be noted that revenues from advertising on specialised channels (+5.3 million euros, +10.3%) and web advertising

(+1.2 million euros, +22.2%) continue to grow.

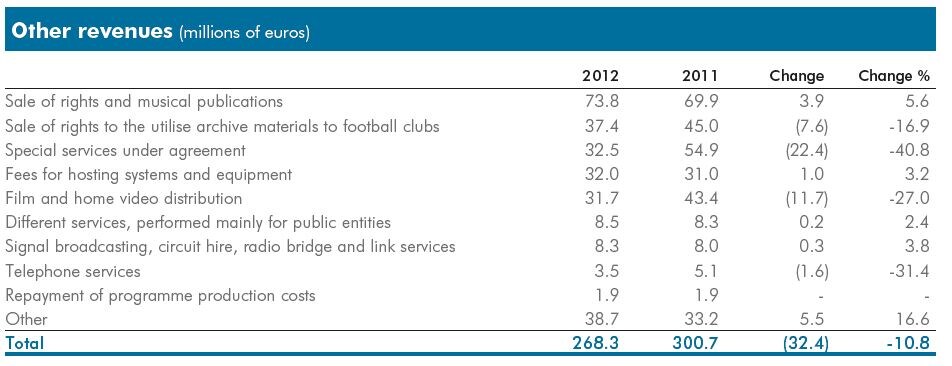

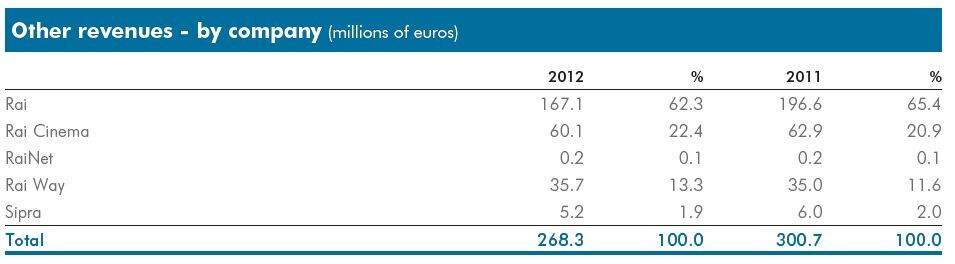

Other revenues present a reduction of 32.4 million euros (-10.8%), as highlighted in detail in the table below.

The reduction is determined mainly by the drop in the Parent Company’s Special services under agreement item (-22.4 million

euros), resulting largely from reduction of amounts provided by the Presidency of the Council of Ministers to 50% compared

to that envisaged for the previous year, by Rai Cinema’s Film and home video distribution (-11.7 million euros), mainly as a

result of the crisis affecting the film industry, with a drop in cinema-goers of about 10% compared with 2011 and by the Parent

Company’s Sale of rights to utilise materials to football clubs (-7.6 million euros), the reduction of which is due to different

agreements entered into during the two years.

A breakdown of other revenues, per company and net of transactions between Group companies, is presented in the following table.

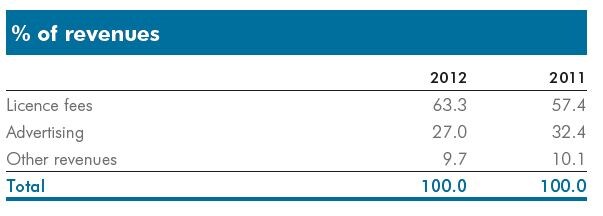

Due to the advertising crisis and the reduction of other revenues, as indicated in the table to the right, revenues from licence

fees represent about 63% of the Group’s overall income.

Operating costs

These total 2,300.1 million euros, up 21.5 million euros, 0.9%, compared with 2011, the reasons for which are listed below.

The item includes internal costs (labour cost) and external costs, regarding ordinary business activities, according to the following

classification.

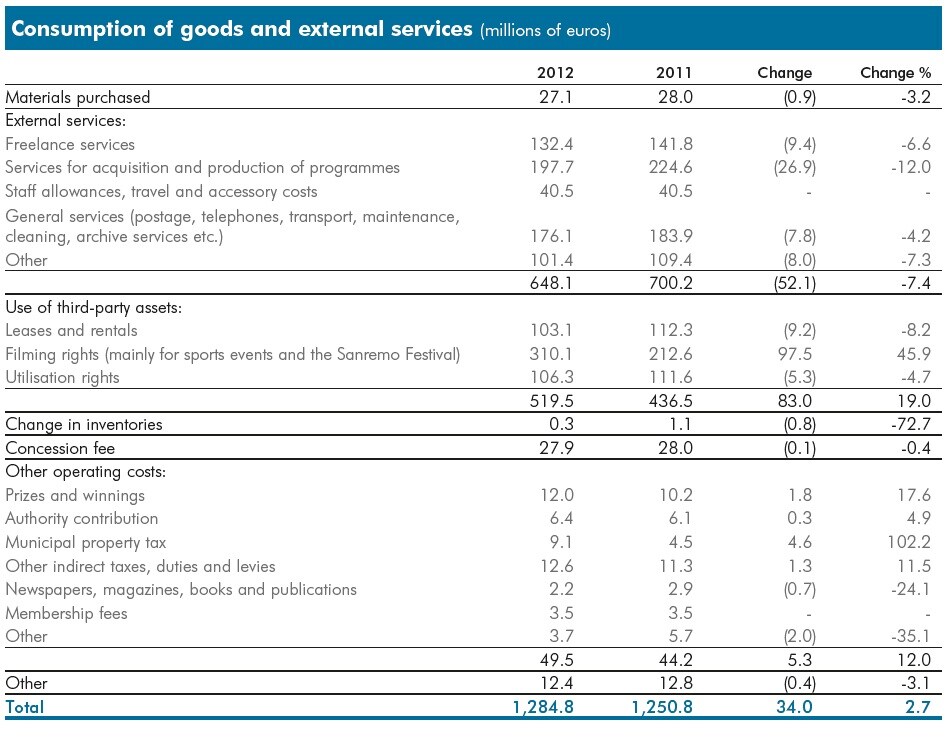

External goods and services – This caption includes purchases of goods and services required to make programmes of

immediateuse (purchases of consumables, external services, artistic collaborations, etc.), filming rights for sports events, copyright,

running costs (rental and hire fees, telephone and postage costs, cleaning, maintenance, etc.) and other operating costs

(direct and indirect taxes, contribution to the Authority, the public broadcasting concession fee, etc.).

Compared with the previous year, the item shows an increase of 34.0 million euros (+2.7%), due to the presence during the

year of costs related to four-yearly sports events (European Football Championship and Olympic Games) for 143.0 million

euros (including costs for the production of these events amounting to 8.1 million euros). Net of this component, there was a

net reduction of about 109 million euros in external costs compared to 2011, determined largely by initiatives implemented

during the year to contain spending.

The table below shows details of savings in most items, apart from filming rights which presents an increase of 97.5 million

euros for the reasons already disclosed.

A breakdown by individual Group company of the cost of goods and services, net of transactions between Group companies,

is given in the following table:

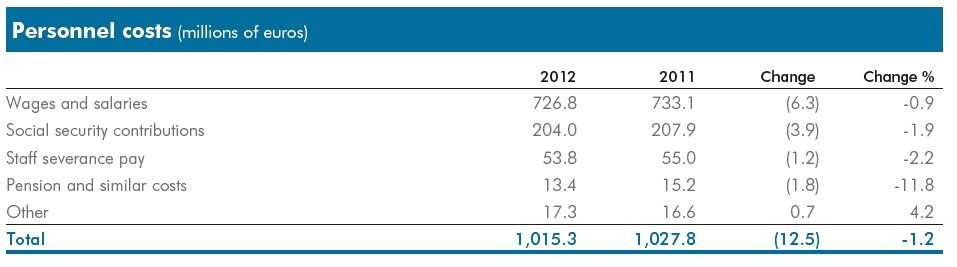

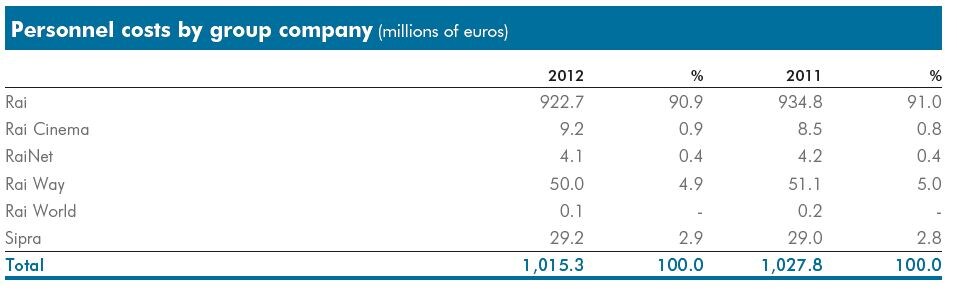

Personnel costs – These amount to 1,015.3 million euros, down by a total of 12.5 million euros on the total at 31 December

2011 (-1.2%), as detailed in the table below.

The reduction in personnel costs is determined mainly by the provision of a bonus system for employees, about 20 million

euros lower than that assigned in the previous year.

Net of the phenomenon mentioned above, personnel costs presented a modest increase (about 8 million euros) due to the

positive effects of incentives in 2011 which offset the physiological growth in personnel costs as a result of contractual automatic

pay increases and the impact of the renewal of the collective labour contracts.

Lower inflation also positively influenced the trend of personnel costs, having a positive impact on the revaluation of the

provision for staff severance pay and the continuation, once again in 2012, of the substantial blockage of payment policies.

A breakdown of personnel costs by individual Group company is given in the following table.

Personnel on payroll at 31 December 2012 (including 49 work-introduction and apprenticeship contracts) amounted to

11,661, up 251 on the same date of the previous year. In detail, Group company leavers numbered 206, of whom 82 left

under resignation incentives, while engagements numbered 457, 413 of which following the signing of permanent employment

contracts by temporary workers in application of trade union agreements, 24 returns to work following legal action and

3 compulsory replacements.

The average number of employees, including those on fixed-term contracts, came to 13,158, up 25 on the previous year

due to an increase of 213 in the number of staff on permanent contracts and reduction of 188 in the number of staff on

fixed-term contracts.

Gross Operating Margin

The Gross Operating Margin, as a consequence of the above, is positive by 486.4 million euros, down 233.3 million euros,

or 32.4%, on the previous year.

Amortisation of programmes

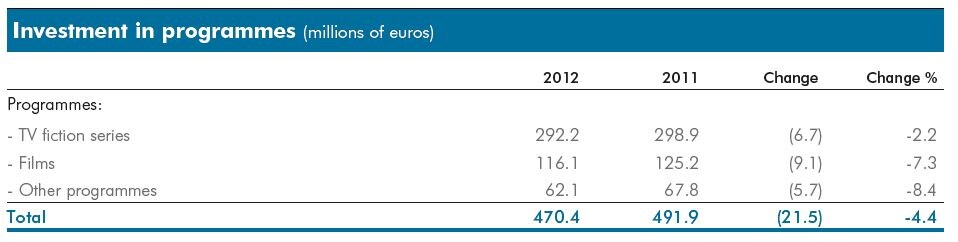

This caption is related to investments in programmes which, during 2012, amounted to 470.4 million euros, down 21.5

million euros (-4.4%), as highlighted in the following table.

A breakdown of investments in programmes by each individual company is shown in the following table:

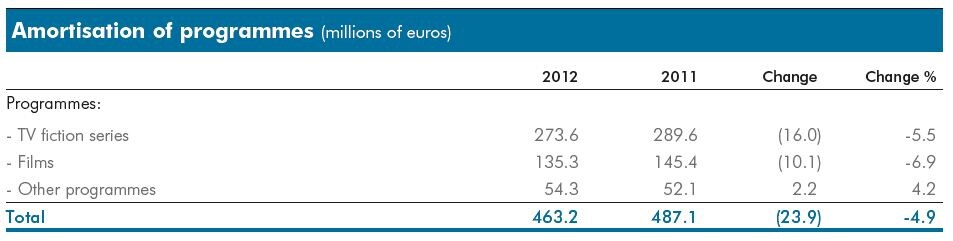

Amortisation charged to the above captions for the year, 463.2 million euros, shows a reduction of 23.9 million euros

(-4.9%) compared with the previous year, related to the performance of investments.

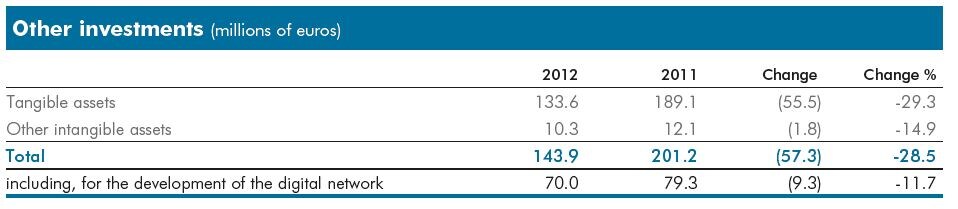

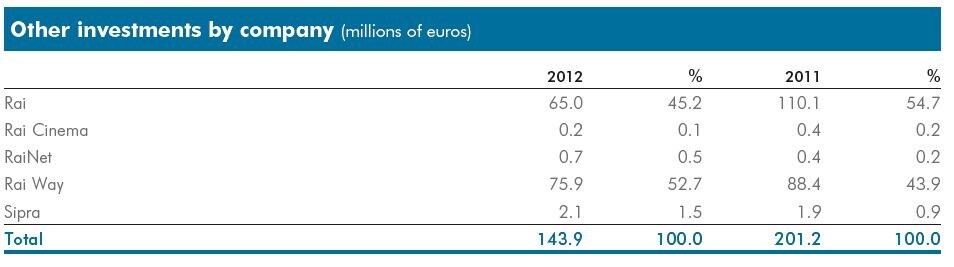

Other amortisation and depreciation

The 2012 movement in this item, shown in the following table, is linked to investments in non-current tangible assets and

other investments, and presents a total reduction of 57.3 million euros (28.5%), largely determined by the previous year’s

acquisition of the DEAR property complex by the Parent Company for an amount of 52.5 million euros.

The tables below show the breakdown by company and type:

Amortisation and depreciation for the period referring to the items mentioned above amount to 140.6 million euros, with

an increase of 10.4 million euros compared to 2011, referring mainly to the entry into operation of the investments made by

Rai Way, in this and previous years, following extension of the DTT network to the whole country.

Other net income (charges)

The item comprises costs/revenues not directly related to the Company’s core business and, in 2012, highlights net expenses

of 47.3 million euros (39.8 million euros in the previous year). In detail, it comprises expenses for repeat-usage programmes

which it is not expected will be used, repeated or commercially exploited for 31.3 million euros ( 29.9 million euros at 31 December

2011), provisions for risks and charges for 26.7 million euros ( 18.1 million euros at 31 December 2011), provision

for bad debts for 6.6 million euros ( 6.5 million euros at 31 December 2011), provision for the supplementary pension fund

for former employees for 12.1 million euros (13.9 million euros at 31 December 2011,), partially offset by net contingent

assets for 21.8 million euros (21.2 million euros at 31 December 2011) and releases of provisions allocated in previous years

for 11.5 million euros (8.8 million euros at 31 December 2011).

Operating result

The performance described above for operating revenues and costs led to a deterioration in the operating result, from +62.6

million euros in the previous year to -164.7 million euros this year, with a drop of 227.3 million euros.

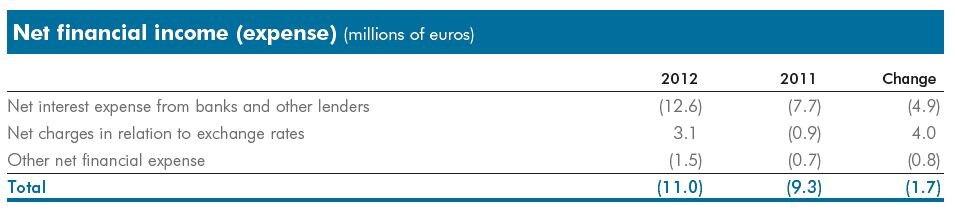

Net financial expense

Net financial expense shows a negative 11.0 million euros, down on 2011 (-9.3 million euros). The item shows the economic

effects of typical financial operations and comprises bank interest expense and income as well as that relating to Group

companies and net gains/losses in relation to exchange rates..

The figures show an increase in net interest payable to banks of 4.9 million euros due to higher financial exposure to third

parties and an increase in the average interest rates on loans.

Exchange rate differences, mainly generated by the acquisition by Rai of rights to sports events and by Rai Cinema to film and

television rights in US dollars, were positive and increased thanks partly to hedging activities carried out in previous years,

which counteracted the fluctuations in the euro/dollar exchange rate during the year. Other financial expenses, which grew,

are influenced by higher bank commissions for new loans and interest on the factoring on Sipra receivables.

The average cost of loans, consisting of current account credit lines, “hot money”, stand-by and medium-term loans and a

factoring line, settled at 3.4% (2.8% in the previous year), up in relation to the increased weight of fixed rate debts compared

to the previous year.

Net exceptional expense

This item amounts to 50.9 million euros (6.8 million euros in 2011) and refers mainly to costs sustained for actions to incentivise

early staff resignation (68.4 million euros) partially offset by the gain from the reimbursement of IRES (corporate income

tax) for the full deductibility of IRAP (regional tax on production) relating to personnel costs and similar (16.8 million euros).

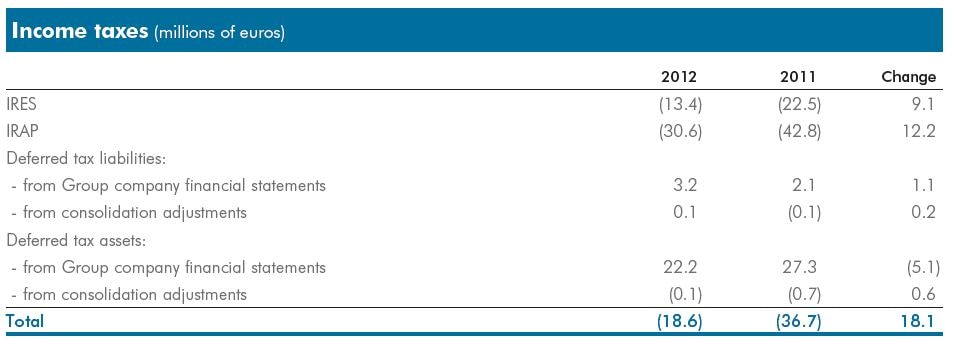

Income taxes

These amount to 18.6 million euros and represent the balance between current and deferred taxes as shown in the table.

IRES of 13.4 million euros presents a reduction of 9.1 million euros on the previous year’s figure, relating to the better economic

results of certain Group companies.

No amount was recorded for IRES for the Parent Company, as the year is expected to have a negative tax result.

IRAP for 30.6 million euros is down on the previous year, mainly due to the lower taxable base of the Parent Company.

Deferred tax liabilities in 2012 determine a positive effect equating to 3.2 million euros (2.1 million euros in 2011), mainly as

a consequence of the reversal of the temporary differences in income deriving from higher amortisation applied by the Parent

Company in previous years for tax purposes.

Deferred tax assets (27.3 million euros) originated from the booking of IRES credit deriving from:

• the negative taxable base of the Parent Company, which was offset by the positive taxable amounts of the subsidiaries,

included within the scope of consolidation for the 2012 tax year, with a positive taxation effect of 13.3 million euros;

• newly booked temporary differences of the Parent Company for programme assets, which we are sure will be recovered in

that they are transformable into tax credits, as provided for by paragraphs 55, 56 and 56 bis of Law Decree 225/2010,

as amended by Law Decree 201/2011, with a positive tax effect of 8.1 million euros.

Balance Sheet aggregates

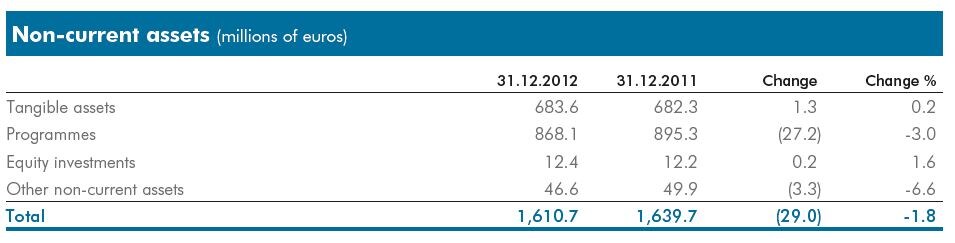

Non-current assets

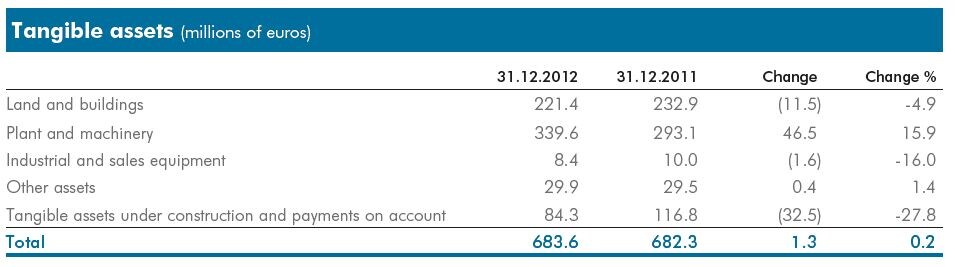

Tangible assetswhich have remained largely stable, are detailed in the following table.

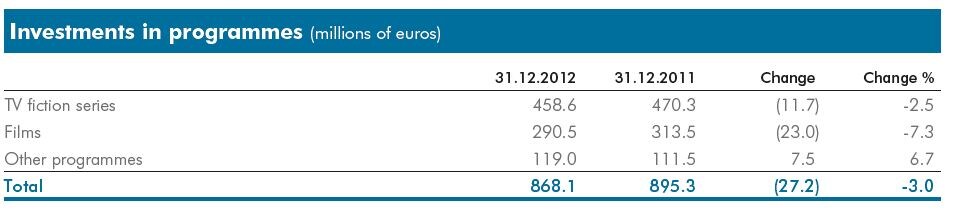

Investments in programmes are detailed in the following table:

Equity investments amount to 12.4 million euros, show no significant changes compared to the previous year.

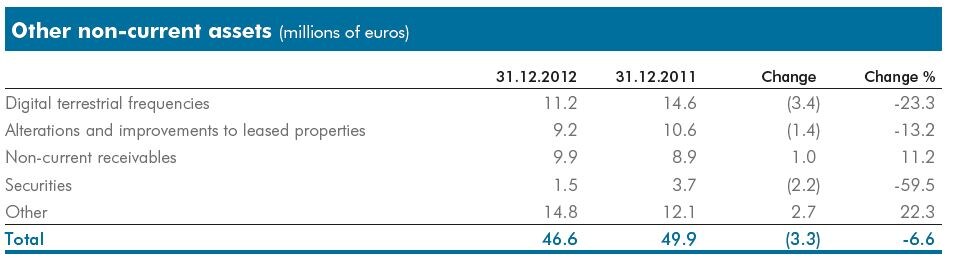

Other non-current assets are shown in the following table:

Working capital

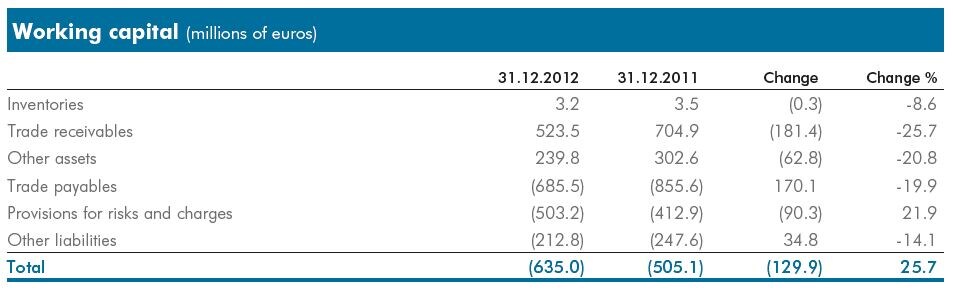

The change from 2011 (-129.9 million euros) is due mainly to normal developments in the business.

Major changes relate to:

• Trade receivables: receivables: down 181.4 million euros, due to lower amounts of receivables mainly relating to Sipra’s advertising

receivables as a result of the contraction of advertising and by lower receivables for special services rendered by the Parent

Company to the Government under contract;

• Other assets: down 62.8 million euros largely due to the recoupment of the advance payments made to purchase the

broadcasting rights for sports events held during the year (particularly the European Football Championships and the

Olympic Games);

• Trade payables: down 170.1 million euros, due mainly to certain Parent Company previous year’s accounts payable to

suppliers for the purchase of sports broadcasting rights and the DEAR property complex;

• Provisions for risks and charges: up 90.3 million euros, mainly to cover charges for staff resignation incentives (68.4

million euros) and expenses linked to the renewal of the labour contract of white and blue collars (about 19 million euros).

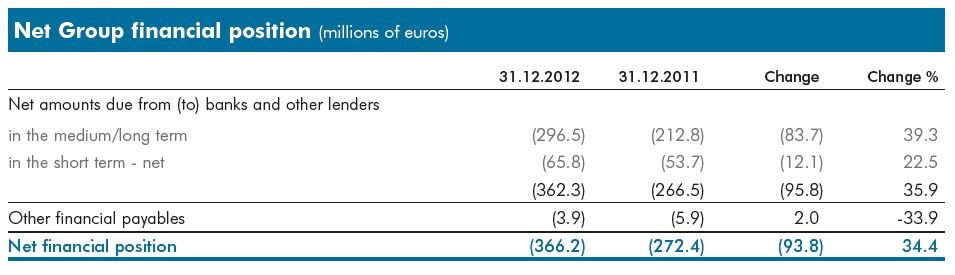

Net financial position

The year-end net financial position is negative by 366.2 million euros, showing a considerable deterioration compared to

the previous year (-272.4 million euros) and is made up as follows:

The growth of debt was caused by a flow of activity during the year which, due to the negative economic result, was insufficient

to cover the requirements determined by the year’s investments. The latter include the payment of the second instalment for

purchase of the DEAR property complex which accounts for 34 million euros.

As regards the effects on cash flow during the year, the following should be pointed out:

• the negative flows are due to considerable reduction in advertising revenues;

• the positive flows relate tothe recovery of amounts receivable for special services rendered to the Government under contract

and the limitation of the outlays for current expenses by Rai and the associated companies during the year;

The unsecured loan of 295 million euros taken out during the year as part of a pool envisages the respect of two parametric/

equity ratios:

• Net Financial Debt, net of government receivables for licence fees/Shareholders’ equity <= 1.5

• Net Financial Debt, net of government receivables for licence fees/Gross Operating Margin <= 1

At 31 December, these ratios were fully respected, settling a 1.23 and 0.73 respectively.

The average net financial position is negative by 338 million euros (-254 million euros in 2011), with a deterioration of 84

million euros which is more limited than the final figure, which reflects the more favourable breakdown of the fee instalments,

consequential to the 100 million increase in the amount paid with the second and third instalments.

The analysis carried out on the basis of additional balance sheet and income statement ratios highlighted that:

• Net Financial Debt, net of government receivables for licence fees/Shareholders’ equity ≤ 1.5

• Net Financial Debt, net of government receivables for licence fees/Gross Operating Margin ≤ 1

At 31 December, these ratios were fully respected, settling a 1.23 and 0.73 respectively.

The average net financial position is negative by 338 million euros (-254 million euros in 2011), with a deterioration of 84

million euros which is more limited than the final figure, which reflects the more favourable breakdown of the fee instalments,

consequential to the 100 million increase in the amount paid with the second and third instalments.

The analysis carried out on the basis of additional balance sheet and income statement ratios highlighted that:

• the net invested capital coverage ratio, ratio, calculated as the ratio between net invested capital and own capital, is 2.26

(1.51 at 31 December 2011);

• the financial debt coverage ratio, calculated as the ratio between net financial debt and own capital, is 1.26 (0.51 at

31 December 2011);

• the current ratio,identified in the ratio between current assets (inventories, current assets, cash and cash equivalents and

financial receivables) and current liabilities (current liabilities and financial debts), is 0.79 (0.87 at 31 December 2011);

• the self-coverage ratio of non-current assets, of non-current assets, calculated as the ratio of Shareholders’ equity to non-current assets, is 0.18

(0.33 at 31 December 2011).

The financial risks to which the Group is exposed are monitored using appropriate computerised and statistical instruments.

A policy regulates financial management in accordance with best international practices, the aim being to preserve the corporate

value by taking an adverse attitude towards risk, pursued via active monitoring of the exposure and the centralised

implementation of suitable hedging strategies by the Parent Company, also acting on behalf of the subsidiaries.

In particular:

• The exchange risk is significant in relation mainly to the exposure in US dollars generated by the acquisition of rights to

sports events in foreign currencies by Rai and of film and television broadcasting rights by Rai Cinema. These commitments

generated payments for about 175 million dollars during 2012. Operation takes place from the date of subscription to

the commercial commitment, often lasting several years, and aims to defend the counter value in euros of commitments

estimated at the time of order or in the budget. Hedging strategies are implemented using financial derivative instruments

– such as forward purchases, swaps and options without ever taking on an attitude of financial speculation. The Group

policy envisages the operating limits to be observed by the hedging activity.

• The rate risk is also regulated by the Company policy, particularly for medium/long-term exposure with specific operating

limits. In relation to the medium-term loan described above, Interest Rate Swap agreements were entered into during 2011

for 205 million euros, with the aim of transforming the cost of the loan, issued at floating rate and therefore subject to

market volatility, to fixed rate.

• The credit risk on cash deployment is limited in that the company policy envisages the use, for limited periods of cash

surpluses, of low-risk financial instruments with parties with high ratings. Only tied deposits or sight deposits with remunerations

close to the Euribor rate were used during 2012.

• As regards the liquidity risk, the Group has, in the medium term, a loan, taken out as part of a pool, for 295 million

euros (expiring in 2015), with six-monthly amortisation as of 2013. With the banking system, short-term and reversible

credit lines were opened for a maximum amount of about 450 million euros. Stand-by loans are also in place for a total

of 90 million euros, maturing in February 2013, along with a factoring line valid against Sipra receivables for about 50

million euros. The existing loans allow coverage of overdrafts during the year, on condition that payment of the fees by

the Ministry of the Economy and Finance takes place in observance of the contractual quarter-end deadlines. A specific

long-term loan of 100 million euros was taken out with the European Investment Bank to provide further coverage of the

requirements of the progress of the DTT project during the year. This loan will be disbursed in two instalments during 2013.

|

|