home > report on operations > RAI's offering

TV product performance

2011 was characterised by further

growth of the dissemination of DTT. At

the end of the year, the all-digital

regions had become fourteen,

accounting for 78% of the Italian

population.

The most significant effects of the

expansion and diversification of the

television offering include the increase

in the television audience, which

continues the growth trend that, since

2009, has witnessed the media rise to

increasingly higher levels compared to

previous years.

2011 was yet another record year for

viewing figures: for the first time since

the Auditel measuring system was

introduced, more than 10 million

viewers were reached over the whole

day (10.1 million compared to 9.8

million in 2010) while the prime time

audience was of 25.5 million viewers

(25.8 million average viewers, clearly

higher than the previous peaks reached

in 2004 and 2010 in which the

audience reached 25.1 million).

These results are excellent, particularly

because they were achieved in a year

with no big sports events (World and

European Football Cups, Winter and

Summer Olympics) which usually make

a considerable contribution to the

growth of television consumption.

In a competitive and quickly

transforming setting, the Rai Group

continues to confirm its leading role.

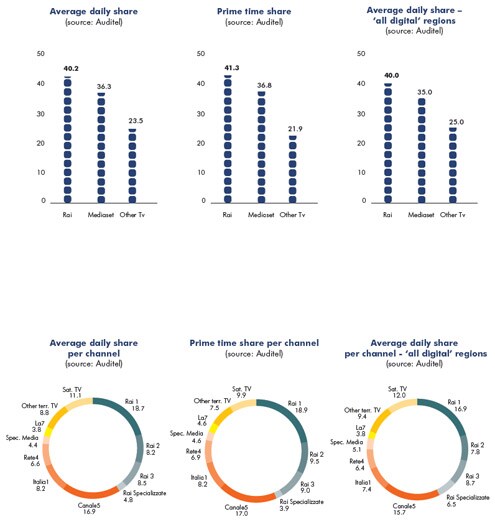

On an average day, Rai consolidates

its share with 40.2% di share (-1.1%

compared to 2010) compared to

Mediaset’s 36.3% (-1.3%).

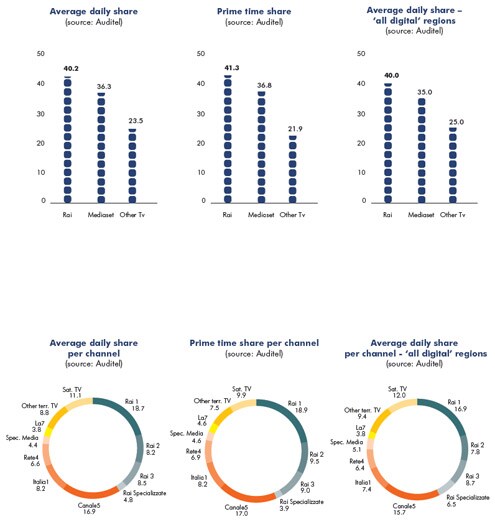

This occurs within the scope of a

general increase in the shares obtained

by specialized satellite or digital

terrestrial channels: excluding the Rai and Mediaset networks measured by

Auditel, the totality of ‘satellite TV

broadcasters’ rises to 11.1% (+1.6

share points on 2009), while ‘Other

terrestrial TV broadcasters’ reach 8.8%

(+0.2%).

The result of the Rai Group is largely

due to the performance of the

specialized channels (‘Rai Specializzate’),

which obtain a total all-day share of

4.8% (with an increase of +1.8 points

compared to 2010), influenced mainly

by Rai 4, Rai Premium, Rai Yoyo, Rai

Movie and Rai News (which more than

doubled its share).

This makes Rai Italy’s first digital

broadcaster, followed by Mediaset

(4.4%), Sky (4.0%), Fox (1.7%) and all

the other Italian and international

competitors such as Discovery,

Switchover Media, Disney, Viacom, and

Turner.

Rai’s general-interest channels, like

those of the competition (apart from

La7), endured a physiological decline,

with the three Rai channels maintaining

their leadership:

• Rai 1 with a share of 18.7% is

confirmed as the most watched

channel and retains its advantage

over the leading Mediaset channel

(-2 points compared to 2010 for both

channels);

• Rai 2 is at 8.2% (-0.9 points) and is

the fourth Italian channel, bypassed

only by Canale 5 and the other two

Rai channels;

• Rai 3 is stable at 8.5% and becomes

the third Italian channel.

In Prime Time the Rai Group confirms

its leadership with a share of 41.3% (-

2.4% compared to 2010) against

Mediaset’s 36.8% (-0.7% points).

The prime time slot has also been

characterised by a growth in ‘Other TV’ to the detriment of the traditional

general-interest offering, with all

‘Satellite TV’ totalling a 9.9% share

(+1.4 percentage points on 2010) and

‘Other terrestrial TV’ climb to 7.5%

(+0.2).

Rai 1 is confirmed as the leading

channel with a 18.9% share and bypasses

Canale 5 by almost two percent

despite the absence in 2011 of

important football events, which

conditioned performance (-3.4 points

compared to 2010, which was

characterised by the World Cup and

during which an Italian team won the

Champions League).

Rai 2 and Rai 3 continue to be the most

watched channels after the leading

channels, with 9.5% (-0.4 points

compared to 2010) and 9.0% (-0.1

points) respectively.

The combined offering of the ‘Rai

Specializzate’ channels reaches a share

of 3.9%, up +1.5 percentage points

compared to 2010.

By the end of the first half of 2012 the

switchover to DTT is expected to be

completed across the whole of Italy.

Between May and June, the analogue

signal will also be switched off in the

Southern Italian regions which have

still to become involved: Abruzzo,

Molise, Apulia, Basilicata, Calabria

and Sicily.

For details on the competitive setting

for the near future, it is interesting to

focus on viewing figures for the ‘all

digital’ regions which, at the end of

2010, had already completed the

switchover to DTT (Piedmont, Valle

d’Aosta, Lombardy, Trentino Alto

Adige, Veneto, Friuli Venezia Giulia,

Emilia Romagna, Lazio, Campania and

Sardinia). These areas, which comprise

about 65% of the Italian population, had a broader television offering than

the rest of the country for the whole of

2011.

The results coming from the ‘all digital’

regions are very positive and prove the

validity of the choices made by Rai.

On the average day, Rai prevails over

Mediaset even more than in the other

areas of Italy: Rai group reaches 40%

against Mediaset’s 35%.

Over the 24 hours, Rai’s three generalinterest

channels have overtaken those

of the direct competition (33.5% against

29.6%).

The ‘Rai Specializzate’ networks, with an

offering on DTT divided over eleven

channels, obtain a total share of 6.6%

and place five channels in the ranking

of the 15 most popular digital

broadcasters (free and pay). Particularly

evident are Rai 4 (1.2%), Rai Premium

(1.1% share) and Rai YoYo (1.0%).