| home > report on operations > financial position > review of balance sheet, income statement and financial position |

home > report on operations > financial position > review of balance sheet, income statement and financial position

review of balance sheet, income statement and financial position

Income Statement

The Parent Company Income Statement

for 2011 recorded a net profit of 39.3

million euros, against a loss of 128.5

million euros in 2010.

Following the merger by incorporation

of the subsidiary Rai Trade into Rai,

which took place during the year,

backdating the accounting effects to 1

January 2011, in order to ensure a fair

comparison of this year’s results with

those of last year, an Income Statement

and a Balance Sheet resulting from the

consolidation of the two companies, as

highlighted by the reclassified statements

presented at the side, have been drawn

up for reference.

The result for 2011 shows an

improvement of 167.4 million euros

compared to 2010, which closed with a

loss of 128.1 million euros.

The following section provides an

overview of the main items of the

Income Statement and the reasons

behind the more significant changes

from the figures of the previous year.

Revenues from sales and services

Revenues from sales and services consist

of licence fees, advertising revenues and

other commercial revenues.

They totalled 2,824.8 million euros, down

33.9 million euros (-1.2%) on 2010.

Licence fees (1,708.4 million euros).

These include licence fees for the

current year as well as those for

previous years, collected through

coercive payment following legal registration.

They also include accounts,

albeit for a residual amount, receivable

from the Ministry of the Economy and

Finance for unpaid licence fees relating

to subscribers exempted from payment.

The overall increase (+1.4%) refers to

the increase in the per-unit licence fee

from 109.00 euros to 110.50 euros

(+1.4%). Worth noting is the increase in

the number of paying subscribers

(+0.2%) and the drop in new

subscribers (-3.1%), returned to the

levels of 2009.

Once again in 2011 the licence fee

paid in Italy continues to be one of the

lowest in Europe.

By way of example, the table shows the

annual licence fee, in euros, in force in

the most important European countries.

Advertising revenues.

In a setting

characterised by the deceleration of the

economy and a drop in consumptions,

advertising revenues in 2011 also

showed evident signs of difficulty.

Overall, the trend in advertising

revenues in 2011 must be interpreted

not only in the light of the global

deceleration of the economy, which has

caused a general resizing of advertising

budgets, but also in comparison to

2010, a year characterised by the

presence of big sports events, such as

the South Africa World Cup and the

Vancouver Winter Olympics.

The Nielsen figures make it possible to

estimate a reduction on the overall

market of about 4%, with significant

reductions on all media, apart from the

Internet, which closed at (+12.3%).

Television and radio advertising

investments in particular recorded a

drop of 3.1% and 7.8% respectively.

In this context, Rai’s advertising

revenues (883.9 million euros)

highlight a reduction of 59.6 million

euros (-6.3%) compared with 2010, as

highlighted in the table at the side.

The significant continuing growth of

advertising revenues from the

specialised channels should be noted

(+17.0 million euros, +70.0%).

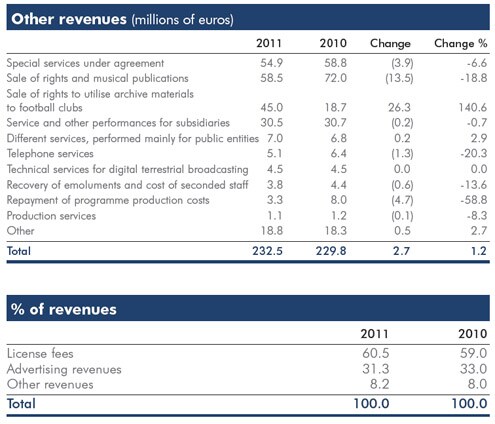

Other revenues present an increase of

2.7 million euros (+1.2%), determined

by a number of negative factors, as

shown in the following table.

The main differing factors include the

positive item, Sale of rights to utilise

archive materials to football clubs,

which presents an increase of 26.3

million euros due to the different effects

of the agreements entered into during

the two years, and the negative items

Sale of rights and musical publications

(-13.5 million euros), the reduction of

which is largely due to the sale of

foreign broadcasting rights for the

matches of the Italian Football

Championship in relation to different

contracting methods for these

operations (-5.4 million euros), without

having significant net effects on the

Income Statement, and to Musical

Publications (-3.1 million euros).

Other less important reduction factors

are Special services under agreement

(-3.9 million euros) as a consequence

of the reorganisation of activities

envisaged under the foreign

broadcasting agreement, and the

Repayment of programme production

costs (-4.7 million euros) mainly due to

the absence of proceeds related to the

creation of a long-running TV series.

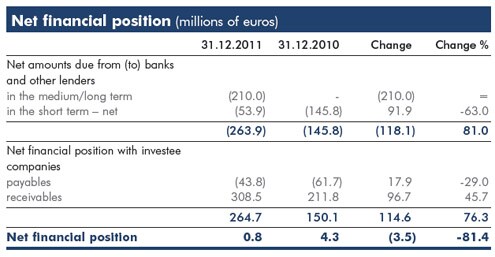

As shown in the dedicated table, the

influence of revenues from licence fees

accounts for about 60% of the total,

while Advertising and Other revenues

amount to about 40%.

Operating costs

The item includes internal costs (labour

cost) and external costs, regarding

ordinary business activities.

These total 2,517.1 million euros, down

by 158.6 million euros, -5.9%,

compared with 2010, as detailed below.

Consumption of goods and external

services – This caption includes

purchases of goods and services

required to make programmes of

immediate use (purchases of

consumables, external services, artistic

collaborations, etc), filming rights for

sports events, copyright, services from

subsidiaries, running costs (rental and

hire fees, telephone and postage costs,

cleaning, maintenance, etc.) and other operating costs (direct and indirect taxes,

contribution to the Authority, the public

broadcasting concession fee, etc.).

As shown in the table, the caption

shows a drop of 175.9 million euros

(-10.0%), determined mainly by the

reduction of costs for the purchase of

filming rights, essentially related to

sports rights (-86.0 million euros).

2010, like all other even numbered

years, was characterised by the

presence of four-yearly sports events

(World Cup and Winter Olympics)

influencing the 2010 income statement

by 107.8 million euros.

This reduction

was partially offset by higher costs for

the purchase of the broadcasting rights

for the Italian National Football Team’s

friendly and qualifying matches for the

2012 European Championships.

Regarding Group companies there were

lower costs for purchasing film and

series viewing rights from Rai Cinema

for 51.8 million euros, following the

contractual renegotiation of relations

with the company in 2011, and higher

costs for the activities performed by Rai

Way (+5.4 million euros), mainly for the

extension of broadcasting and

transmission of the DTT signal.

In addition to the above, savings were

observed in other components of the

caption, confirming a continuation of

the cost cutting policies.

Personnel costs – These amount to

935.3 million euros, up by a total of

17.3 million euros on the total at 31

December 2010 (+1.9%), as detailed

in the table at the side.

The growth in personnel costs is justified

almost entirely by the provision of a

bonus system for executives, middle

management, white and blue collars

(about 16.6 million euros) not

envisaged in the previous year as it was

not paid. Regardless of this component,

personnel costs for 2011 closed at a

very similar value to that of 2010.

This result derives from a series of

management measures to offset the

economic growth ensuing from

automatic pay increases provided for by

the labour contract, the stabilisation of

those on temporary employment

contracts, the rise in the staff severance

pay revaluation index and provisions to

cover contractually agreed holidays for

middle management, white and blue

collars and orchestra members.

Among the actions taken, incentives for

resignation and the substantial blockage

of management policies played the most

significant role.

Personnel on payroll at 31 December

2011 amounted to 10,196 units, up 56

on 31 December 2010.

The average number of employees,

including those on fixed-term contracts,

came to 11,829, with a reduction of

124 members of staff compared to last

year.

In detail, there has been a drop of

97 members of staff on fixed-term

contracts following stabilisation of staff

on temporary contracts and the

resignation of 27 members of staff on

permanent contracts due to the

simultaneous resignation incentives.

Gross Operating Margin

The Gross Operating Margin, as a

consequence of the above, is positive for

321.8 million euros, up 120.9 million

euros, or 60.2%, on the previous year.

Amortisation of programmes

This caption is related to investments

in programmes, which during 2011

amounted to 255.3 million euros, down

26.8 million euros (-9.5%), mainly due

to TV fiction series.

Amortisation charged to the above

captions for the year, 240.3 million

euros, shows a reduction of 26.3

million euros (-9.9%) compared with the

previous year, related to the

performance of investments.

Other amortisation

This is linked to investments in tangible

non-current assets and other

investments, the movements of which

during 2011, highlighted in the

following table, present an overall

increase of 56.1 million euros,

determined mainly by the purchase of

the DEAR property complex for 52.5

million euros.

Depreciation and amortisation charged for the year in relation to the

above captions amount to 68.1 million

euros, with a drop of 0.4 million euros

compared with 2010.

This substantial

stability is due to the offsetting effect

between the increase in depreciation

and amortisation due to high levels of

investment during the year and the

reduction determined by the progressive

completion of the amortisation of assets

acquired in the past.

Other net income (charges)

The caption comprises costs/revenues

not directly related to the Company’s

core business and, in 2011, highlights

net charges of 36.9 million euros (20.5

million euros in the previous year). In

detail, it comprises expenses for repeatusage

programmes which it is not

expected will be used or repeated (29.2

million euros, with 34.7 million euros in

2010), provision for the company

supplementary pension fund for former

employees (13.8 million euros, 9.7

million euros in 2010), provisions for

risks and charges (10.8 million euros,

15.4 million euros in 2010), partially

offset by net contingent assets (18.1

million euros, 27.4 million euros in

2010) and the release of funds

allocated in previous years (8.8 million

euros, 16.4 million euros in 2010).

Operating Result

The results described above for

operating revenues and costs led to an

improvement in the operating result,

from -154.7 million euros in the

previous year to -23.5 million euros this

year, with an increase of 131.2 million

euros.

Net financial income (expense)

The item Net financial income

(expense) amounts to a negative 0.6

million euros (income of 2.7 million

euros in 2010). The caption shows the

economic effects of typical financial

operations and comprises bank

interest expense and income to/from

banks as well as that relating to

Group companies and net exchange

gains.

The details show a drop in net interest

payable to banks of 3.7 million euros

against higher financial exposure to

third parties and an increase in the rates

applied. The simultaneous growth in

loans to the associated companies,

particularly to Rai Cinema and Rai Way,

determined higher intercompany interest

income of 2.6 million euros.

Exchange rate differences, mainly

generated by the acquisition of rights

to sports events in US dollars, were

positive thanks to hedging activities

carried out in previous years, which

limited the oscillations of the

euro/dollar exchange rate during the

year. Other financial expenses are

deteriorating as a result of higher bank

commissions and interest payable to

suppliers for extended payments

established by contract.

The average cost of loans, made up of

credit lines on current accounts, ‘hot

cash’, stand-by and medium-term loans,

increased in relation to the increase in

the spread applied to bank loans,

settling at 2.8% (1.9% in the previous

year).

Income from equity investments

As indicated in the table below, the

caption amounts to a total of 76.4 million

euros and includes the dividends collected

in the period considered valid for the

results of the previous year (80.2 million

euros), the revaluations (2.6 million euros)

and writedowns of equity investments for

impairment losses totalled during the year

(6.4 million euros), 5.0 million of which

relating to Rai Corporation, due to the

expenses connected to the close of the

activities resolved during 2011.

Net exceptional expense

This caption amounts to 4.8 million

euros (45.0 million euros in 2010) and

relates mainly to costs sustained for the

continuation of actions to incentivise

early staff resignation, launched during

the previous year.

Income taxes

The caption amounts to 8.2 million

euros (positive value of 11.4 million

euros in 2010), determined by the

balance between current and deferred

taxes, as detailed in the table.

As regards the IRES tax, no amount was

booked as the year’s result for tax

purposes was negative.

IRAP, amounting to 36.0 million euros,

shows an increase of 9.7 million euros

compared with the previous year,

determined by a higher taxable amount.

Deferred tax liabilities determine a

positive effect of 2.7 million euros (the

same as in 2010), as a consequence of

the reversal of the temporary differences

of income deriving from the higher

amortisation applied in previous years

for tax purposes only.

Deferred tax assets (25.1 million euros)

originated from the booking of IRES

credits deriving from:

• negative taxable income, which is

offset by the positive taxable income

of subsidiaries, included within the

scope of the tax consolidation

mechanism for tax year 2011 for

16.5 million euros;

• temporary differences in income

which will arise during the next year,

within the limit of the Group’s taxable

income foreseeable during said year,

for 8.5 million euros;

• other changes in IRAP for 0.1 million

euros.

Balance sheet

Non-current assets

Tangible non-current assets are

detailed in the table to the right.

Investments in programmes are

mainly represented by TV fiction series

(314.1 million euros), which accounted

for the greater part of investments

during the year (255.3 million euros).

The details are given in the table at the

side.

Equity investments fell slightly (-2.2

million euros) largely due to the

revaluation and writedowns of the

companies.

Other non-current assets are shown in

the table at the side.

Working capital

The change from 2010 (+10.7 million

euros) is due mainly to normal

developments in the business.

Major changes relate to:

• Trade receivables: up 47.3 million

euros, due to higher amounts of

receivables from Group companies

(+25.7 million euros) and from other

customers (+21.0 million euros), the

latter determined by fewer collections

of amounts receivable for special

services rendered to the Government

under contract.

• Other assets: up 74.5 million euros

largely due to advance payments

made to purchase the broadcasting

rights for sports events to be held next

year (particularly the European

Football Championships and the

Olympic Games).

• Trade payables: up 115.9 million

euros, due partially to greater

exposure towards subsidiaries and

partially to certain accounts payable

in relation to contracts with football

clubs and for the purchase of sports

broadcasting rights and DEAR

property complex.

It should be noted that Trade

receivables comprise, net of the

relative writedowns, consisting for the

most part in accounts receivable from

subsidiaries, mainly Sipra, and from

public entities and institutions.

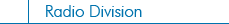

Net financial position

The year-end net financial position is

positive, despite the decline compared

to the previous year (0.8 million euros

compared with 4.3 million euros in

2010), and is comprised as indicated in

the table.

The net financial position is very similar

to that of the previous year. There was

an increase in accounts receivable from

the subsidiaries Rai Way and Rai

Cinema and a simultaneous increase in

exposure towards banks.

This neutral position was determined by

the positive economic result and the

additional self-financing components,

which generated a financial flow capable

of covering the requirements determined

by investments during the year.

This is confirmed by very contained cash

flows on the main outgoings, capable of

offsetting the lower advertising revenues

and income from special services

rendered to the Government under

contract.

In May 2011, an unsecured pool loan

was taken out at the best market

conditions for 295 million euros with

five bank counterparties, and as at 31

December 2011, 210 million euros of

the loan amount had been used.

The loan, converted in observance of the

company policy for about 70% at a

fixed rate through an Interest Rate Swap,

must be repaid in full by 31.12.2015,

with amortisation beginning in June

2013, in constant six-monthly

instalments.

The loan envisages the observance of

two parametric/equity indexes, to be

calculated on the basis of the

consolidated financial statements, which

are extensively observed.

The average net financial position is

positive, despite dropping compared

with the previous year (from 55 to 18

million euros).

The analysis carried out on the basis of

the balance sheet and income

statement ratios highlighted that:

• the net invested capital coverage

ratio, calculated as the ratio between

net invested capital and net equity, is

1.00 (0.99 in 2010);

• the current ratio, identified as the

ratio between current assets

(inventories, current assets, cash and

cash equivalents and financial

receivables) and current liabilities

(current liabilities and financial debts),

is 1.19 (1.00 in 2010);

• the self-coverage ratio of noncurrent

assets, calculated as the ratio

of shareholders’ equity to non-current

assets, is 0.39 (0.36 in 2010).

The financial risks to which the

Company is exposed are monitored

using appropriate computerised and

statistical instruments.

A policy

regulates financial management in

accordance with best international

practice, the aim being to preserve the

corporate value by taking an adverse

attitude towards risk, pursued via active

monitoring of the exposure and the

implementation of suitable hedging

strategies, also acting on behalf of the

Group companies.

In particular:

• The exchange risk is significant in

relation to the exposure in US dollars

generated by the acquisition of sports

events rights and the funding of the

associated company Rai Corporation.

These commitments generated

payments for about 65 million dollars

during 2011.

Operation takes place

from the date of subscription to the

commercial commitment, often lasting

several years, and aims to defend the

counter value in euros of

commitments estimated at the time of

order or in the budget.

Hedging

strategies are implemented using

financial derivative instruments – such

as forward purchases, swaps, and

options structures – without ever

taking on an attitude of financial

speculation.

The company policy

envisages numerous operating limits

to be observed by the hedging

activity.

• The interest rate risk is also

regulated by the company policy,

particularly for medium/long-term

exposure with specific operating limits.

In relation to the medium-term loan

described above, Interest Rate Swap

agreements were entered into for 205

million euros (131 of which to start

on 31.12.2011), with the aim of

transforming the cost of the loan,

issued at a floating rate and therefore

subject to market volatility into a fixed

rate.

• The credit risk on cash deployment is

limited in that the company policy

envisages the use, for limited periods

of cash timing differences, of low-risk

financial instruments with parties with

high ratings.

Only tied deposits or

sight deposits with remunerations

close to the Euribor rate were used

during 2011.

• As regards the liquidity risk, it should

be noted that the company, in a

period characterised by marked uncertainty, consolidated its financial

structure by taking out the mediumterm

loan described above, of which

210 million euro had been used at

31.12.2011 (thanks to the extension

of the possibility of use for the whole

of the first year after subscription).

Short-term credit lines have been

opened with the banking system for a

maximum amount of about 515

million euros, which during the recent

tensions on the financial markets have

presented problems of complete

usability.

Stand-by loans are also in

place for a total of 130 million euros,

and are due to expire in February

2012, and in the first quarter of 2012

they were renewed for 90 million

euros. The existing loans allow

coverage of overdraft periods during

the year, on condition that the

liquidation of the fees by the Ministry

of the Economy and Finance takes

place more or less in line with the

quarter-end dates established by

contract. To cope with the significant

investments required by the DTT

project – in the absence of significant

public contributions – preliminary

activities continue with the European

Investment Bank for the opening of a

specific medium/long-term loan.

|

|