| home > 2011 financial > consolidated > notes to the consolidated financial statements |

home > 2011 financial > consolidated > notes to the consolidated financial statements

Notes to the consolidated financial statements

1) Introduction

The Rai Group consolidated financial statements have been prepared in accordance with the provisions of the Italian Civil

Code and Legislative Decree 127 of 9 April 1991. The following documents are annexed to the consolidated financial statements:

the reclassified statements comprised of tables for the analysis of the balance sheet and income statement, and of

cash flows.

In order to render the financial statements at 31 December 2011 fully comparable with those of the previous year, certain

items have been reclassified.

The consolidated balance sheet, income statement, notes and related schedules are expressed in millions of euros.

The consolidated financial statements reporting date is 31 December 2011, which is the year-end date for all consolidated

companies.

The financial statements of consolidated companies are those approved by their relevant corporate bodies.

The consolidated financial statements and the accounts of the individual consolidated companies have been audited by PricewaterhouseCoopers

SpA.

The reconciliation between Rai and Group results and equity for 2011 and 2010 is presented on page 269.

2) Scope of consolidation

Rai and all companies in which the Parent Company Rai holds - directly or indirectly - the majority of voting rights at ordinary

Shareholders’ Meetings are included in the scope of consolidation.

The following companies are consolidated on a line-by-line basis (figures for share capital are at 31 December 2011):

• Rai Cinema SpA; registered office in Rome, Piazza Adriana 12, share capital 200,000,000.40 euros; shareholders: Rai

100%.

• Rai World SpA; registered office in Rome, Viale Mazzini 14, share capital 1,300,000 euros; shareholders: Rai 100%.

• RaiNet SpA; registered office in Milan, Corso Sempione 27, share capital 5,160,000 euros; shareholders: Rai 100%.

• Rai Way SpA; registered office in Rome, Via Teulada 66, share capital 70,176,000 euros; shareholders Rai 100%.

• Sipra SpA; registered office in Turin, Corso Bernardino Telesio 25, share capital 10,000,000 euros; shareholders: Rai

100%.

With the deed of merger dated 23 February 2011, backdated to 1 January 2011, Rai Trade SpA was merged by incorporation

into Rai.

Also, with the deed of merger dated 21 March 2011, backdated to 1 January 2011, 01 Distribution Srl was merged by incorporation

into Rai Cinema SpA.

Lastly, on 29 November 2011, Rai’s Board of Directors resolved the closure of Rai Corporation. In this situation the condition

by which the company must be considered as a going concern ceased to exist and the company’s financial statements were

prepared in compliance with liquidation criteria. Consequently, the company is no longer consolidated using the line-by-line

method, but is valued at equity. In the reclassified statements, comprised of tables for the analysis of the balance sheet and

income statement, and of cash flows, the comparative values reflect the effects of deconsolidation of the company.

The following companies are recorded using the equity method:

• Audiradio Srl in liquidation; registered office in Milan, Largo Toscanini 1, share capital 258,000 euros; shareholders: Rai

27%, others 73%.

• Auditel Srl; registered office in Milan, Largo Toscanini 1, share capital 300,000 euros; shareholders: Rai 33%, others 67%.

• Euronews - Société Anonyme; registered office in Lyon Ecully (France), 60 Chemin des Mouilles; share capital 3,848,610

euros; shareholders: Rai 21.54%, others 78.46%.

• Rai Corporation - Italian Radio TV System; registered office in New York, 32 Avenue of the Americas; share capital

500,000 US$; shareholders: Rai 100%.

• San Marino RTV SpA; registered office in the Republic of San Marino, Viale Kennedy 13; share capital 516,460 euros;

shareholders: Rai 50%, E.Ra.S. 50%.

• Tivu’ Srl; registered office in Rome, Via di Villa Patrizi 8, share capital 1,000,000 euros; shareholders: Rai 48.16%, others

51.84%.

3) Consolidation principles and foreign currency translation methods

These can be summarised as follows:

a) The book values of equity investments in consolidated companies and the corresponding portion of their net equities have

been eliminated against the total incorporation of the assets, liabilities, costs and revenues of such companies (regardless

of percentage of ownership); minority interests’ shares in equity (and the results for the year) are shown in specific items.

Any differences emerging have been taken directly to consolidated equity.

b) Payables and receivables, expense and income, dividends and other transactions made between consolidated companies

have been eliminated.

c) For consolidation purposes, the financial statements of consolidated companies have been brought into line with the accounting

policies and methods described hereunder.

4) Accounting policies

Before examining the individual items, we have provided an overview of the main accounting policies used, which were

adopted from the perspective of the group as a going concern and comply with the provisions of Articles 2423 et seq. of the

Civil Code and Legislative Decree 127 of 9 April 1991. Such policies are substantially unchanged from those applied in the

previous year. There are no exceptional cases requiring derogation from the requirements under Article 2423-bis et seq. of

the Civil Code.

a) Industrial patents and intellectual property rights:

The acquisition and production costs of programmes, composed of external costs that can be allocated directly to

each project and the cost of internal resources used to create programmes, are recorded according to the following

criteria:

1) Costs for repeat-use television productions are capitalised under intangible assets and, if such productions are usable

at year-end, are carried under industrial patents and intellectual property rights and amortised on a straight-line basis

over the period of their estimated useful life. If such programmes are not yet usable at year-end, the costs are carried

under intangible assets under development and payments on account.

The objective difficulty of establishing an appropriate correlation between advertising revenues and licence fees and

the amortisation of the rights, which is further complicated by the many ways in which they can been used, has led to

the useful life of repeat-use programmes being estimated as follows:

• three years for TV series productions or in general for all non-film productions;

• four years for football library exploitation rights;

• five years for free TV rights acquired by Rai Cinema, except for products for which the whole range of rights has

been acquired (film, television, home video etc) the useful life of which is estimated at seven years.

Costs for concession rights with a shorter duration are amortised over the period they are available.

In addition, an impairment provision has been established for programmes for which transmission, re-broadcasting or

commercial exploitation is at risk.

2) Costs for immediate-use television programmes are expensed in a single year, which is normally that in which they are

used. More specifically:

• News, light entertainment and all radio programming. Costs are expensed in the year in which they are incurred,

which is normally the year in which the programmes are broadcast.

• Sports events. Costs are booked to the year in which the event takes place.

• Documentaries, classical music and drama. Costs are charged against income in a single amount at the time the

programmes are ready for broadcasting or the rights are usable.

b) Software licences are carried with industrial patents and intellectual property rights net of amortisation and are amortised

over three years from the year they enter service.

c) Costs incurred for the construction of the digital terrestrial network are capitalised under intangible assets net of

amortisation and amortised on a straight-line basis over the estimated period of use from the date the service is

activated.

d) Trademarks are amortised over ten years from the year they enter service.

e) Deferred charges are carried under other intangible assets net of accumulated amortisation.

They regard improvements to

leased or licensed property and accessory charges on loans. Amortisation for leasehold improvements is determined on

the basis of the shorter of the residual duration of the related contracts and the estimated period of benefit of the costs, calculated

using amortisation rates which reflect the rate of economic deterioration of the relative assets. Accessory charges

on loans are amortised in relation to the duration of the loan.

f) Tangible assets – which are shown net of accumulated depreciation – are recorded at cost, increased by internal personnel

costs incurred in preparing them to enter service, increased following revaluations pursuant to laws.

The costs of tangible assets as determined above are amortised in accordance with Article 2426 (2) of the Civil Code.

Ordinary maintenance costs are expensed in the year in which they are incurred.

g) Financial leases have been booked by recording the asset and relative debt in the consolidated balance sheet in amounts

which, at the beginning of the contract, are equal to the normal value of the leased asset. Depreciation of such leased

assets is calculated on a straight line basis at 6% per annum (insofar as it is related to real properties). Leasing instalments

are split between the portion representing financial charges, which are taken to the income statement as such, and the

principal portion, which is taken as a reduction to the relative debt.

h) Equity investments in non-consolidated subsidiaries and associated companies are carried at equity; equity investments below

20% and interests in consortia are shown at cost adjusted for any permanent impairment in value. In the event of investee

companies with negative equity (in deficit), the investments are written down in full and an additional amount is set up in the

provisions for risks and charges for the portion of the deficit pertaining to the Group. Adjustments for permanent impairment are

reversed in the event that such impairment is subsequently recovered due to sufficient operating earnings by the investee company.

i) Fixed-income securities carried as non-current financial assets are valued at purchase cost. Positive or negative differences

between purchase cost and redemption value are taken to income in the amount accruing for the year.

j) Non-current assets which, at the balance sheet date, have suffered a permanent impairment in value, are carried at the

lower value. Should the reasons for the writedown made in previous years no longer apply, the assets are revalued within

the limits of the amount of the writedown.

k) Other securities carried under current financial assets are valued at the lower of purchase cost – determined as the

weighted average cost – and estimated realisable value, which is given by market value.

l) Inventories of raw materials, supplies and consumables (technical materials) are valued at purchase cost, which is determined

on the basis of weighted average cost, written down taking account of market trends and estimated non-use due to

obsolescence and slow turnover. Inventories of items for resale (books, DVDs, etc.) are carried at the lower of purchase cost,

which is determined on the basis of weighted average cost, and estimated realisable value as determined by market prices.

m) Accrued income and prepaid expenses, and accrued expenses and deferred income, are recorded on an accruals basis

for the individual entries.

n) Provisions for pension and similar liabilities, which comprise the provision for supplementary staff severance pay, the social

security benefits provision and the company supplementary pension fund, are made in accordance with collective bargaining

agreements. The Company supplementary pension fund is valued on the basis of an actuarial appraisal.

o) The provision for taxes includes probable tax liabilities arising out of the settlement of tax disputes and includes deferred

tax liabilities calculated on timing differences which have resulted in lower current taxes. Deferred tax assets arising from

charges which are tax-deductible on a deferred basis and from tax losses are taken up under Current Assets caption 4 ter

(“Deferred tax assets”) if there is reasonable certainty that they will be recovered in the future.

p) Other provisions for risks and charges include provisions to cover specific losses or liabilities, the existence of which is

certain or probable, but the amount or date of occurrence of which is uncertain. They are set up on a case-by-case basis

in relation to specific risk positions and their amount is determined on the basis of reasonable estimates of the liability that

such positions could generate.

q) The provision for staff severance pay is determined in conformity with applicable law and labour contracts. It reflects the

accrued entitlement of all employees at the balance-sheet date net of advances already paid.

r) Payables are shown at nominal value; receivables are carried at estimated realisable value, net of the provision for bad

debts as determined on the basis of a case-by-case assessment of the solvency risks of the individual debtors.

s) Payables and receivables denominated in currencies other than the Euro – with the exception of hedged positions, which

are valued at the rate applying to the financial instrument – are recorded at the exchange rates applying at the balance

sheet date. Profits and losses ensuing from such conversion are taken to the income statement as components of financial

income or expense. Any net profit is taken to a specific non-distributable reserve until the profit is realised.

t) Payments on account include advances paid by customers for services that have not yet been performed.

u) Costs and revenues are taken to the income statement on a consistently applied accruals basis.

v) Dividends are taken to income in the year in which they are received.

w) Income taxes are recorded on the basis of an estimate of taxable income in conformity with applicable regulations, taking

account of deferred tax positions.

The tax liability to be settled on presentation of the tax declaration is carried under taxes

payable, together with liabilities relating to taxes already assessed and due.

The tax charge in the Group’s consolidated

financial statements reflects the tax charges in the individual financial statements of consolidated companies, which have

been aligned on the basis of uniform accounting policies and prepared on a prudent basis.

Companies consolidated using the line-by-line method have opted to be taxed on a Group consolidated basis and have

transferred to the Parent Company the duty of attending to all requirements regarding the settlement and payment of IRES

tax.

The procedure for the consolidation of the Group’s taxable amounts is regulated by a specific agreement between the

Parent Company and the subsidiaries. The fundamental standards that regulate this agreement are neutrality (absence of

negative effects on the single companies, proportionality in the use of losses and their integral remuneration on the basis

of the rate of IRES in force at the time of effective use, offsetting the incomes booked.

x) During consolidation, the tax effects on consolidation adjustments resulting in timing differences on the Group’s result

have been recorded as prepaid taxes and deferred taxes.

y) In order to hedge interest rate and exchange rate risk, the Company uses derivative contracts to hedge specific transactions.

Interest differentials to be collected or paid on interest rate swaps are taken to the income statement on an accruals

basis over the duration of the contract. Accrued interest differentials that have not been settled at the end of the year

or which have been settled before they actually accrue are taken to accrued income and prepaid expenses, or accrued

expenses and deferred income, as the case may be. Derivative contracts hedging exchange rate risks are used to cover

contractual commitments in foreign currencies and entail adjusting the value of the underlying item. The premium or

discount arising from the differential between the spot and future exchange rates for hedging transactions carried out via

future acquisition of value and premiums paid in relation to options is taken to the income statement over the duration of

the contract.

If the market value of derivatives contracts that do not fully qualify for hedge accounting is negative, the figure is allocated

to the specific risk provision.

z) Collections are recorded by bank transaction date; for payments account is likewise taken of the instruction date.

5) Consolidated Balance Sheet

Assets

Non-current assets

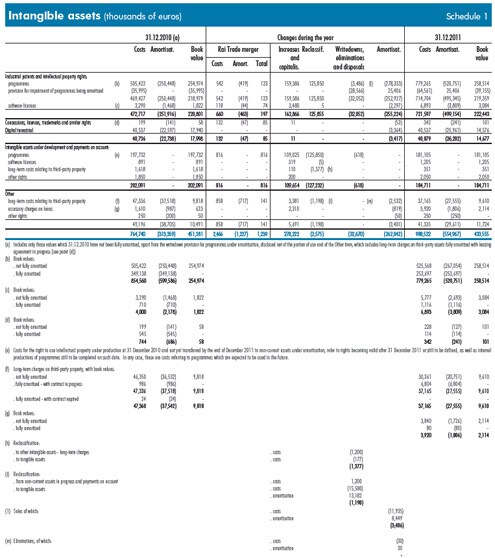

Intangible assets

This caption includes the cost of non-physical factors of production with lasting utility, net of amortisation and writedowns in

the event of permanent impairment of value.

These total 932.6 million euros, with a net reduction of 32.1 million euros on the preceding year, represented by the balance

between new investments (517.1 million euros), the amortisation charge for the year (512.9 million euros), writedowns and

eliminations (30.0 million euros), disposals (1.0 million euros), as well as other decreases for (5.3 million euros, 2.8 million

euros of which due to the change in the scope of consolidation).

As shown in schedule no. 1, the caption is composed as follows:

Formation, start-up and expansion costs. These are booked to the financial statements of Rai World for an insignificant

amount (at 31 December 2010: insignificant).

Industrial patents and intellectual property rights. These amount to 642.3 million euros and are comprised as follows:

• 637.5 million euros for the cost of television programmes and films available for use, booked mainly to the financial

statements of the Parent Company and Rai Cinema, showing a net reduction of 5.1 million euros compared to the figure

relating to 31 December 2010. This reduction is represented by the difference between new assets for 524.0 million euros

(of which 174.5 million euros transferred from intangible assets under development and payments on account for rights

that became available during the year), a writedown against the risk of non-transmission, repeatability and commercial

exploitation of certain programmes amounting to 29.3 million euros and the amortisation charge for the year of 499.8

million euros;

• 4.8 million euros for software rights, showing a net increase of 0.6 million euros compared to the figure relating to 31

December 2010. The aforementioned reduction is particularly represented by the difference between new assets for 3.8

million euros and the amortisation charge for the year of 4.4 million euros.

As regards television and film products available for use, at 31 December 2011 the item total, gross of writedowns, was split

between:

• rights to television programmes owned or held under unlimited-term licences amounting to 265.3 million euros (at 31

December 2010: 250.3 million euros);

• rights to third-party television programmes held under fixed-term licences amounting to 412.5 thousand euros (at 31

December 2010: 438.3 million euros).

Overall investment in television programmes made in 2011 amounts to 505 million euros, including 155.5 million euros in

programmes which were not yet available at 31 December 2011, which are carried under intangible assets under development

and payments on account.

Analysing investments by type, at 31 December 2011, 344.4 million euros have been invested in fiction programmes (series,

miniseries, TV movies, soap operas etc.), 79.8 million euros in films, 28.4 million euros in cartoons and comedy programmes,

13.1 million euros in documentaries, 10.6 million euros in classical music and drama, 8.3 million euros in football libraries

and 20.4 million euros in other categories.

Concessions, licences, trademarks and similar rights. These items, which are stated net of accumulated amortisation,

include costs incurred on the acquisition of licences for digital terrestrial frequencies, and own trademarks.

These amount to

14.7 million euros (at 31 December 2010: 18.1 million euros) of which 14.6 million euros referring to digital frequencies (at

31 December 2010: 17.9 million euros).

Non-current assets under development and payments on account. These amount to 261.9 thousand euros, including:

• 257.8 million euros for the cost of television programmes and films which are not yet available, and therefore not subject

to amortisation, and compared with the figure as at 31 December 2010, showing a net reduction of 20.6 million euros.

In particular, the aforementioned reduction is equal to the balance between increases for new assets (155.5 million euros),

decreases for items transferred to Industrial patents and intellectual property rights in that they relate to productions and/or

purchases that became usable during the year (174.5 million euros), to eliminations and disposals for 1.6 million euros;

• 1.6 million euros for software programs and analysis, showing a net increase of 0.5 million euros compared to the figure

relating to 31 December 2010, due to increases for new assets;

• 0.5 million euros refer to alterations and improvements underway on property under leasehold or concession and, compared

with the figure as at 31 December 2010, show a net reduction of 1.2 million euros;

• 2.0 million euros refer to the cost to purchase options on agreements for the commercial exploitation of products held

in football libraries recorded in the financial statements of the Parent Company and, compared with the figure as at 31

December 2010, show a net increase of 0.2 million euros.

For television programmes and films that have not yet become available, the total of 257.8 million euros includes:

• 131.4 million euros for television programmes owned by the Company that were not ready at 31 December 2011 or for

which usage rights began after 31 December 2011 (at 31 December 2010: 158.8 million euros). These comprise costs

of 9.0 million euros relating to the production of a long-running fiction series which has been interrupted for the moment

following production problems with the company responsible for production;

• 126.4 million euros regarding third-party television programmes held on fixed-term licence beginning after 31 December

2011 (at 31 December 2010: 119.6 million euros).

Other intangible assets. The amount of 13.7 million euros includes:

• 10.1 million euros for costs incurred, net of accumulated amortisation, on alterations and improvements to property under

leasehold or concession (31 December 2010: 13.2 million euros);

• 2.1 million euros, net of accumulated amortisation, relating to long-term loan agreements to be distributed throughout

their duration (at 31 December 2010: 0.6 million euros);

• 1.5 million euros relating to investments in software programs and analyses (at 31 December 2010: 1.7 million euros).

The amount relating to the purchase of a right to the first negotiation and option on the broadcasting of football matches was

zeroed: (at 31 December 2010: 0.1 million euros).

Tangible assets

These comprise the costs and related revaluations of non-current tangible assets with a useful life of several years.

They are

carried net of standard depreciation and writedowns for lasting value impairments if any.

The standard depreciation rates applied are listed below:

At 31 December 2011, tangible assets amount to 682.3 million euros and show, overall, a net increase of 68.9 million euros

compared with 31 December 2010, comprised of the balance between new assets (189.1 million euros), depreciation (117.1

million euros), disposals and other reductions (5.6 million euros, 0.2 million euros of which due to the change in the scope

of consolidation) and other increases for 2.5 million euros, as specified in Schedule 2.

It should be noted that new assets recorded, which reflect investments made in the year, comprise 7.0 million euros for the

capitalisation of the cost of internal personnel engaged in the construction of buildings, plant and machinery.

The gross value of revaluations recorded under non-current tangible assets is reported below, listed according to the applicable

regulations:

• 0.2 million euros gross in implementation of Law 823 of 19 December 1973;

• 38.3 million euros gross in implementation of Law 576 of 2 December 1975 and law 72 of 19 March 1983;

• 57.4 million euros gross in implementation of Law 413 of 30 December 1991;

• 499.3 million euros gross in implementation of Law 650 of 23 December 1996.

Financial assets

These represent the cost of durable financial investments and related revaluations, net of any writedowns described in the

comments on the individual items.

These total 24.8 million euros and are comprised as follows:

Equity investments in non-consolidated subsidiaries. These amount to 1.7 million euros (at 31 December 2010:

no

value) and represent the Shareholders’ equity of Rai Corporation following the change in the method used to evaluate the

investment as specified earlier.

Equity investments in associated companies. These relate to companies not falling within the scope of the consolidation

in which interests of over 20% are held and over which a dominant influence is not exercised. Details follow:

Equity investments in the associated companies are all held in Rai portfolio.

Equity investments in other companies. These total 0.8 million euros and are comprised as follows:

Receivables from others. These amount to 8.9 million euros (at 31 December 2010: 6.3 million euros) and are comprised

as follows:

• guaranteed minimums relating to mandates for the sale of rights and other commercial initiatives for 6.5 million euros;

• guarantee deposits of 2.0 million euros;

• loans granted to employees of 0.4 million euros;

The composition of these captions is shown in Schedule 3, Schedules 6 and 8 detail their distribution by maturity, type and

currency, while Schedule 7 by geographic area.

Other securities. These amount to 3.7 million euros (at 31 December 2010: 3.8 million euros) and are entirely comprised

of collateral securities.

The composition of the item is shown in Schedule 3.

Current Assets

Inventories

Inventories amount to 3.5 million euros net of the inventory provision (at 31 December 2010: 4.5 million euros).

As shown

in Schedule 4, they comprise:

• Raw materials, supplies and consumables: these amount to 1.3 million euros net of the inventory provision for 14.2 million

euros. They consist almost entirely of supplies and spare parts for maintenance and the operation of equipment, considered

as consumables since they are not directly incorporated into products.

• Contract work in progress: this amounts to 0.2 million euros in Rai Way’s financial statements, relating to costs incurred

on developing the Isoradio network.

• Finished goods and merchandise: these amount to 2.0 million euros net of the inventory provision of 0.5 million euros,

mostly relating to the books and periodicals business, home video distribution and inventories of items acquired in

exchange for advertising.

Receivables

Receivables total 961.7 million euros, showing an increase of 123.6 million euros on 31 December 2010, as can be seen in

Schedule 5, which gives a breakdown of receivables, and in Schedules 6 and 8 which show their distribution by maturity, type

and currency. Their distribution by geographic area is shown in Schedule 7.

Receivables from customers. These are trade receivables. They total 703.7 million euros, with a nominal value of 758.7

million euros which has been written down by 55.0 million euros to bring them to their estimated realisable value and compared

with 31 December 2010 they show an increase of 48.1 million euros.

Details of the caption are divided into:

• receivables from Sipra customers for advertising services sold: exposed for a nominal value of 326.4 million euros, they

show a 18.6 million euro increase on 31 December 2010;

• receivables for services rendered by Rai to the Government under specific agreements: as shown in the following table,

these amount to a nominal 107.1 million euros, up 23.3 million euros on 31 December 2010, equivalent to the balance

between the increase in invoices issued and for amounts accrued for 2011 less collections.

• net receivables for licence fees: these amount to 12.2 million euros, down 22.0 million euros on 31 December 2010,

representing licence fees not yet transferred to Rai. Activities, already successfully pursued in the previous year, will be

launched to recover such receivables. They consist in asking the Ministry of the Economy and Finance to increase the specific

provision of the expense section during the settlement of the Government Financial Statements for 2012, in order to

allow recovery, with liquidation of the fourth instalment of transfer of the fees, envisaged to take place in December 2012;

• other receivables: these amount to a nominal value of 313.0 million euros, up 23.5 million euros compared with 31

December 2010, and represent, among the most significant entries, receivables from customers of Rai for the sale of rights

and various services for 257,8 million euros, receivables from customers of Rai Cinema for 44.6 million euros, receivables

from customers of Rai Way for 8.8 million euros and receivables from customers of Rai World for 1.6 million euros.

Receivables from associated companies. These amount to 0.3 million euros (at 31 December 2010: 0.1 million euros),

and represent the balance of non-financial receivables from the companies San Marino RTV and Tivù which are carried in the

Parent Company financial statements.

Tax receivables. These are carried at a nominal value of 52.9 million euros (at 31 December 2010: 56.3 million euros).

They relate for the most part to receivables recorded in the Parent Company financial statements (48.6 million Euros) for

Group VAT (41.0 million euros) and tax reimbursements requested (7.4 million euros), while the remainder consists of

minority captions.

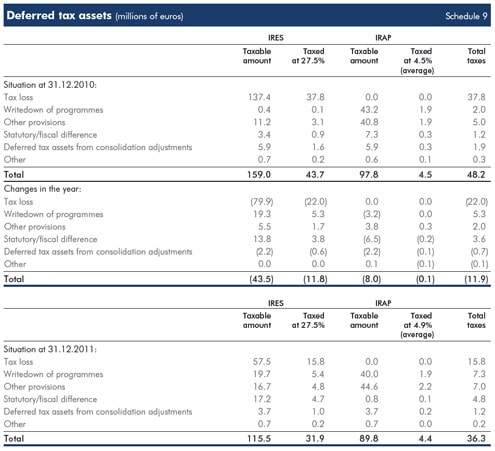

Deferred tax assets. These represent the amount receivable deriving from entries subject to deferred deductibility.

They total

36.3 million euros (at 31 December 2010: 48.2 million euros) comprising deferred tax assets recorded by the individual

companies (35.1 million euros) and deferred tax assets from consolidation adjustments (1.2 million euros).

They are down

11.9 million euros as detailed in Schedule 9. They relate mainly to:

• 27.9 million euros booked to the Parent Company financial statements;

• 4.5 million euros booked to Rai Way’s financial statements;

• 2.1 million euros booked to Sipra’s financial statements;

• 0.6 million euros booked to Rai Cinema’s financial statements.

Receivables from others. These amount to 168.5 million euros (at 31 December 2010: 77.9 million euros). Net of writedowns

of 2.9 million euros, they reflect the value of other types of receivable as described below:

• advances to suppliers on sports events filming rights, carried at nominal value of 123.4 million euros;

• miscellaneous advances to suppliers carried at a nominal value of 15.0 million euros;

• advances to welfare and social security institutions on contributions payable for artistic activities and for advance payments

of severance pay, carried at a nominal value of 14.2 million euros;

• receivables from personnel carried at nominal 6.8 million euros. They are entirely composed of advances of various types,

mainly for travel expenses and production expenses;

• receivables from others, carried at a nominal value of 12.0 million euros.

Cash and cash equivalents

These amount to 18.8 million euros (at 31 December 2010: 3.0 million euros) relating mostly to the Parent Company which

manages central treasury services. They comprise the following:

• Bank and post office deposits: these amount to 18.4 million euros (at 31 December 2010: 2.5 million euros).

They represent

sight or short-term balances on deposit or current account with banks, financial institutions and the Post Office.

• Cash and cash equivalents on hand: these amount to 0.4 million euros (at 31 December 2010: 0.5 million euros) and

include liquid funds in the form of cash and equivalent instruments (duty stamps, cashier’s cheques or bank-guaranteed

cheques etc) in hand at 31 December 2010.

Schedule 8 gives a breakdown of cash and cash equivalents in euros and other currencies.

Accrued income and prepaid expenses

These total 45.8 million euros (at 31 December 2010: 42,2 million euros) and consist of prepaid expenses for 45.8 million

euros and accrued income for an insignificant value.

The composition is detailed in Schedule 10.

Liabilities

Shareholders’ equity

Shareholders’ equity amounts to 535.3 million euros, up 4.5 million euros on 31 December 2010 mainly due to the result

for the year (4.1 million euros).

The components of Shareholders’ equity and the effects of operations carried out in 2011 and the previous year are shown

in Schedule 11.

Share Capital

At 31 December 2011, Rai’s fully paid-in and subscribed share capital was represented by 242,518,100 ordinary shares with

a par value 1 euro each, owned by the Ministry of the Economy and Finance (241,447,000 shares, equal to 99.5583% of

the share capital) and SIAE, the Italian Association of Authors and Publishers (1,071,100 shares, equal to 0.4417% of share

capital).

Legal Reserve

This is booked to the Parent Company financial statements for 7.0 million euros.

Other reserves

Other reserves total 281.7 million euros.

This combination of items comprises:

• 138.7 million euros, of merger surplus;

• 143.0 million euros of other reserves.

Group profit for the year

This amounts to 4.1 million euros.

Provisions for risks and charges

These amount to 412.9 million euros, up 10.2 million euros net on 31 December 2010.

The composition of these items and

details of the aforementioned increase are shown in Schedule 12. The notes which follow provide additional information on

the individual provisions.

Provision for pension and similar liabilities. These amount to 155.6 million euros (at 31 December 2010: 151.8 million

euros) and comprise the supplementary seniority benefits provision, the retirement benefits provision and the company supplementary

pension fund.

• The provision for supplementary seniority benefits amounts to 1.2 thousand euros (at 31 December 2010: 1.5 million

euros). It represents the sums owed in respect of indemnities in lieu of notice towards employees of Rai, Rai Way and

Rai Cinema hired before 1978 who have reached the compulsory retirement age. The amount is revalued each year in

consideration of consumer price inflation. In the event of early termination of employment, or changes in category, the

amounts accrued are released.

• The provision for retirement benefits amounts to 0.3 million euros (31 December 2010: 0.3 million euros), and includes

amounts accrued until 31 December 1988 and annual revaluations allocated in subsequent periods in order to protect

the real value of the provision for eligible Rai employees in accordance with the terms of the national collective labour

agreement.

• The provision for supplementary seniority benefits amounts to 154.1 million euros (at 31 December 2010: 150.0 million

euros).

This includes the expense for supplementary pension benefits currently being paid, consisting of funds accrued

for Rai and Rai Way employees who have opted for the supplementary pension plan under the trade union agreements,

which are kept at an adequate level to ensure said benefits, with respect to actuarial reserves.

It also includes the expense

for supplementary pensions that will be paid to eligible Rai managerial staff still in service in the event that some of these

opt for the supplementary pension plan calculated on the basis of pay earned, seniority and financial and demographic

parameters normally used in similar cases.

Provision for current and deferred taxes. This amounts to 11.5 million euros (at 31 December 2010: 12.0 million euros)

represented by provisions booked to the financial statements of the individual companies, particularly Rai (7.2 million euros),

Rai Way (1.8 million euros) and Sipra (1.8 million euros) and those resulting from consolidation adjustments (0.7 million

euros).

They are down 0.5 million euros as detailed in Schedule 13.

Other provisions. These amount to 245.8 million euros (at 31 December 2010: 238.9 million euros). They include provisions

for costs or losses the existence of which is certain but the amount of which cannot be exactly determined, or which are

probable and the amount of which can be reasonably estimated. They are up 6.9 million euros as detailed in Schedule 12.

As regards pending litigation with employees and third parties, the amount carried in the provisions for liabilities and risks is

the best estimate of the likely liability based on the most up-to-date information available.

Provision for staff severance pay

The provision totals 326.9 million euros (at 31 December 2010: 339.4 million euros). The provision for staff severance pay is

determined at individual level in conformity to the provisions of art. 2120 of the Italian Civil Code, complemented by Budget

Law 2007 (Law 296 of 27 December 2006), which established the entry into force of the new legislation on pension funds

(Legislative Decree 252 of 5 December 2005) as 1 January 2007.

By effect of this legislation, provisions for staff severance pay converge into pension funds other than those inside the company,

unless employees ask to maintain the severance pay within the company: in this case, the provisions are paid into a reserve

managed by the INPS, which will transfer to the company all the benefits disbursed by the latter in the event of payment of

advances or termination of the employment contract, as envisaged by Article 2120 of the Civil Code.

The breakdown of the caption and changes during the year are shown in Schedule 14.

Payables

Payables amount to 1,348.8 million euros, up 186.9 million euros on 31 December 2010. More specifically, financial debt

payable to banks totals 283.3 million euros, with a net increase of 134.5 million euros on the figure disclosed in the 2010

financial statements. No payables covered by collateral in the form of company assets were recorded.

A breakdown of the caption is given in Schedule 15, while Schedules 16 and 17 show the composition of payables by maturity,

type and currency.

With regard to geographic distribution, about 87% relates to Italian residents and about 9% relates to non-EU residents.

The notes indicated hereunder provide further details on the contents of the individual items.

Due to banks. These amount to 283.3 million euros (at 31 December 2010: 148.8 million euros), representing current account

overdrafts with certain banks for 72.5 million euros and medium/long-term loans for 210.8 million euros.

As regards

the latter, the amount of 210.0 million euros booked to the Parent Company financial statements is related to an unsecured

loan taken out in May 2011 with five banks.

The loan, which can be extended up to a maximum of 295 million euros, envisages

full repayment by 31.12.2015, amortisable from June 2013, in constant six-monthly instalments.

This loan, converted in

observance of the company policy for about 70% at a fixed rate through an Interest Rate Swap is destined to hedge investments

in Digital Terrestrial and on the radio and television offering, as well as other production investments.

The loan envisages the

observance of two parametric/equity indexes to calculate on the consolidated financial statements, and they have been fully

observed.

Due to other lenders. They total 2.0 million euros (at 31 December 2010: 2.9 million euros), with 1.2 million euros representing

the balance of the amount due to the leasing company in connection with the financial lease over the building in Aosta

housing the regional office, and 0.8 million euros representing payables booked to Rai Way’s financial statements.

Advances.

These amount to 3.4 million euros (at 31 December 2010: 5.8 million euros) relating entirely to miscellaneous

advances.

Due to suppliers. They total 846.3 million euros (at 31 December 2010: 796.2 million euros) and show an increase of 50.1

million euros with respect to the figure disclosed for the previous year.

They refer entirely to non-financial payables (796.1 million

euros at 31 December 2010); financial payables were zeroed during the year (at 31 December 2010: 0.1 million euros).

Due to non-consolidated subsidiaries. These amount to 7.5 million euros (at 31 December 2010: no value) and regard

Parent Company payables to Rai Corporation not subject to derecognition as a consequence of the change in the method

used to evaluate the investment as specified earlier.

They comprise 5.5 million euros of financial debts and 2.0 million euros

of other debts.

Due to associated companies. These amount to 4.3 million euros (at 31 December 2010: 5.6 million euros) and concern

Parent Company payable to San Marino RTV for 3.6 million euros and with Tivù for 0.7 million euros.

They consist of 0.4 million

euros in financial debts (at 31 December 2010: 1.6 million euros) and other debts of 3.9 million euros (at 31 December 2010:

4.0 million euros).

Taxes payable. These amount to 71.4 million euros (at 31 December 2010: 77.6 million euros) and show a decrease of 6.2

million euros with respect to the figure for the previous year. They consist of:

Welfare and social security institutions. These amount to 52.7 million euros (at 31 December 2010: 50.3 million euros).

They reflect contributions due on remuneration paid to employees and free-lance workers, to be paid over to the institutions

at the scheduled dates. They consist of:

Other payables. These amount to 77.9 million euros (at 31 December 2010: 74.7 million euros). They show a net increase

of 3.2 million euros, as follows:

Accrued expenses and deferred income

These total 45.6 million euros (at 31 December 2010: 50.7 million euros). Details and a comparison with the previous year

are provided in Schedule 18.

The caption contains the entire amount contributed of 42.6 million euros, net of the amount already booked to the income

statement, disbursed by the Ministry for Communications since 2007 in support of initiatives to accelerate the switch-over to

the digital terrestrial platform, consisting of operations on systems and adaptation of the site infrastructures to extend areas

covered by the digital signal and improve reception and the quality of service perceived by the user.

The task of making the necessary investments is entrusted to the subsidiary Rai Way SpA, which is also responsible for the

design, installation, construction, maintenance, implementation, development and operation of the telecommunications networks.

The contribution is disclosed in the income statement of each year in relation to amortisation booked by the subsidiary, taking

into account the relationship between the amount of contributions collected and the total investments envisaged for the

accomplishment of related projects.

6) Memorandum accounts

These amount to 673.4 million euros (at 31 December 2010: 656.0 million euros), formed as indicated in consolidated balance sheet and analysed in Schedules 19 and 20.

Conditions in the hedging contracts covering specific Group commitments and the relative fair values are summarised in

Schedule 21. The fair value of these instruments is determined with reference to the market value on the closing date of the

period under assessment; in the case of unlisted instruments, fair value is determined using commonly used financial evaluation

techniques.

On the whole, hedging contracts entered into are, in observance of the Group Policy, of a reasonable amount in relation to

the overall entity of the commitments subject to such risks.

In addition to the details provided in the memorandum accounts, the amount receivable by the Parent Company from the

subsidiary Sipra, 2.2 million euros has been attached in favour of I.N.P.G.I..

At 31 December 2011 there were no commitments, other than those highlighted among the memorandum accounts, of

particular significance for the purchase or sale of goods and services in addition to those taken on in the normal course of

business that would require specific information to be given for a better understanding of the company’s financial position.

Lastly, Schedule 20 details the amount of company assets held by third parties.

7) Income Statement

Production value

Revenues from sales and services. These have been booked for 2,923.6 million euros, down 38.4 million euros on 31

December 2010, and mainly include revenues pertaining to the year, net of transactions between group companies, from

licence fees and advertising. A breakdown into major components is given in Schedule 22. As can be seen from the distribution

of revenues by geographic area, they are almost all of national origin.

As regards revenues from licence fees, the mechanism used to determine the per-unit fee envisaged by the Consolidated

Broadcasting Law (“separate accounting”), aimed at guaranteeing the proportions between costs sustained by Rai, and certified

by an independent auditor, for the performance of its public service remit and resources from licence fees, highlights a

lack of the latter for the period from 2005 to 2010, totalling over 1.7 billion euros, of which more than 300 million euros refer

to 2010 alone. In 2011, Rai requested, issuing warnings to such effect, the payment of the sums owing to it, as highlighted

on the separate accounting forms, as well as interest matured and to mature.

For 2011, the “separate accounting” figures will be available, as established, within four months of the date on which the

Shareholders Meeting approves the financial statements.

Changes in inventories of work in progress, semifinished and finished goods. These are booked for an insignificant

value (at 31 December 2010: 0.2 million euros) and express the change in the value of inventories associated with the commercial

activity.

Changes in work contracts in progress. These amount to 0.1 million euros (at 31 December 2010: -0.6 million euros) and

refer mainly to the amount carried in the accounts of Rai Way for the completion of the Isoradio network.

Internal cost capitalisations. The amount of 24.4 million euros (at 31 December 2010: 27.6 million euros) represents the

total of internal costs associated with non-current assets, which were capitalised under the specific asset captions. Details are

shown in Schedule 23.

Other production-related income. This totals 93.2 million euros (at 31 December 2010: 112.1 million euros), as detailed

in Schedule 24.

Production costs

This caption comprises costs and capital losses related to ordinary activities, excluding financial operations. The costs shown

here do not include those relating to fixed tangible and intangible assets, which are recorded under the respective asset accounts.

Raw materials, supplies, consumables and merchandise. These total 28.0 million euros (at 31 December 2010: 29.1

million euros), which includes purchases of technical materials for inventory – excluding items used in the construction of plant,

which are allocated directly to fixed assets – production materials (sets, costumes, etc.) and miscellaneous operating materials

(fuel, office supplies, printed documents, etc.), net of discounts and allowances, as shown in Schedule 25.

Services. This totals 700.2 million euros (at 31 December 2010: 735.7 million euros) and comprises costs for freelance

workers and other external services, net of discounts and allowances, as shown in Schedule 26. Among other things, they

include emoluments, remuneration for special functions and reimbursement of expenses paid by the Parent Company to Directors

for 1.9 million euros and to Statutory Auditors for 0.2 million euros. The caption includes independent auditors’ fees for

0.2 million euros and other auditing services for 0.1 million euros.

It should be noted that one Parent Company director and one statutory auditor have also performed similar functions in other

subsidiaries for remuneration which is not of significant amount.

Use of third-party assets. These amount to 436.5 million euros (at 31 December 2010: 535.0 million euros), and express

costs for rents, leases, usage rights and filming rights, as detailed in Schedule 27.

Personnel costs. Employee-related costs amount to 1,027.8 million euros (at 31 December 2009: 1,014.5 million euros),

broken down as indicated in the income statement. The average number of employees on the payroll in 2011 was 13,133, including

employees on fixed-term contracts, work-introduction and apprenticeship contracts (at 31 December 2010: 13,295),

distributed by category and by company, as shown in Schedule 28.

Amortisation, depreciation and writedowns. These total 666.3 million euros (at 31 December 2010: 693.3 million euros),

of which 512.9 million euros relates to amortisation of intangible assets and 117.1 million euros to depreciation of tangible

assets, as detailed in Schedules 1 and 2. They include the writedown of programmes amounting to 29.3 million euros,

which was made to take account of the risk that certain programmes may not be transmitted or re-broadcast, as well as the

commercial exploitation of certain rights.

Changes in inventories of raw materials, supplies, consumables and merchandise. These are carried at a nominal

value of 1.1 million euros (at 31 December 2010: 0.1 million euros) and represent the decrease in net inventories carried

under current assets at 31 December 2011 with respect to the previous year.

Provisions for risks. These amount to 13.7 million euros (at 31 December 2010: 17.2 million euros). They indicate allocations

to provisions for risks. The most significant items are detailed in Schedule 12 and relate mainly to provisions made by

the Parent Company (9.6 million euros).

Other provisions. These amount to 4.5 million euros (at 31 December 2010: 2.2 million euros). The most significant items

are shown in Schedule 12 and relate mainly to provisions booked to the financial statements of Rai (1.4 million euros) and

Rai Way (2.9 million euros).

Other operating costs. These amount to 100.4 million euros (at 31 December 2010: 93.6 million euros). Their distribution

is shown directly in the income statement and further information is provided in Schedule 29. For the most part they refer to

costs disclosed in the Parent Company financial statements (92.3 million euros).

Financial income and expense

Other financial income. This totals 1.2 million euros (at 31 December 2010: 1.7 million euros) and is divided as shown in

Schedule 30.

Interest and other financial expenses. These amount to 9.6 million euros (at 31 December 2010: 5.1 million euros) and

include interest expense, costs for commission on financial services received and other financial operating expenses, as detailed

in Schedule 31.

Foreign exchange gains and losses. These show a loss of total 0.9 million euros (at 31 December 2010: a gain of 3.0

million euros). This item comprises both foreign exchange charges and premiums on foreign currency hedge transactions as

well as the effect of translating the value of payables and receivables in foreign currencies at year-end exchange rates or the

rate in force at the time of the hedge in the case of exchange risk hedges, as detailed in Schedule 32.

Value adjustments to financial assets

Revaluations. These amount to 1.1 million euros (at 31 December 2010: 1.1 million euros), determined by the valuation at

equity of investments in associated companies.

Writedowns. They total 7.0 million euros (at 31 December 2010: 0.1 million euros) and comprise writedowns of non-current

financial assets following losses incurred for the year by the subsidiaries for 6.8 million euros, and of value adjustments of

non-current assets for 0.2 million euros.

Exceptional income and expense

Exceptional items comprise income of 0.1 million euros and expense of 6.9 million euros, as detailed in Schedule 33.

Foreign exchange gains and losses. These show a loss of total 0.9 million euros (at 31 December 2010: a gain of 3.0

million euros). This item comprises both foreign exchange charges and premiums on foreign currency hedge transactions as

well as the effect of translating the value of payables and receivables in foreign currencies at year-end exchange rates or the

rate in force at the time of the hedge in the case of exchange risk hedges, as detailed in Schedule 32.

Value adjustments to financial assets

Revaluations. These amount to 1.1 million euros (at 31 December 2010: 1.1 million euros), determined by the valuation at

equity of investments in associated companies.

Writedowns. They total 7.0 million euros (at 31 December 2010: 0.1 million euros) and comprise writedowns of non-current

financial assets following losses incurred for the year by the subsidiaries for 6.8 million euros, and of value adjustments of

non-current assets for 0.2 million euros.

Exceptional income and expense

Exceptional items comprise income of 0.1 million euros and expense of 6.9 million euros, as detailed in Schedule 33.

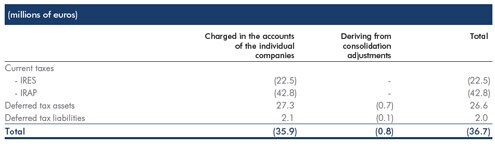

Current income taxes for the year, and deferred tax assets and liabilities

The amount of 36.7 million euros is comprised of current and deferred taxes for the year disclosed in the financial statements

of the individual companies, and of theoretical taxes resulting from consolidation adjustments. The breakdown of the item is

shown in the following table:

8) Result for the year

The year closed with a profit of 4.1 million euros pertaining exclusively to the Group.

9) Reconciliation between Rai’statutory and consolidated financial statements at 31 December 2011 and 31 December 2010

The following table shows the reconciliation between the result for the year and shareholders’ equity as appearing in the Parent

Company and consolidated financial statements:

10) Additional disclosures

As regards disclosures on related parties, no relevant transactions took place within the Group outside of normal market

conditions.

As regards the rulings with which the Court of Auditors – Jurisdictional Section for the Lazio Region – ordered payment to Rai

for state tax damages by certain parties including executives and members of the Board of Director of Rai, against which all

those implicated decided to appeal, it is noted that, in relation to the request for the non-application of the tax regulations

presented by some of those implicated in relation to one of the rulings, after the Chamber of Council of the Court of Auditors

held on 18 January 2012, the Board accepted the application for reduction, quantifying the sum those implicated are

obliged to pay to Rai as 20% of the original sum of the ruling. The positive effects on the financial statements of Rai shall be

disclosed in 2012.

For important events occurring after the closing date and the nature of the Group’s activity, see the Report on Operations.

|

|