| home > 2010 financial > statutory > Nota integrativa |

home > 2010 financial > statutory > Notes to the Parent Company

financial statements

Notes to the Parent Company financial statements

1) Activity of the company

Rai-Radiotelevisione italiana SpA (hereinafter Rai) is exclusively assigned the public service broadcasting of radio and television

programmes using any technical media.

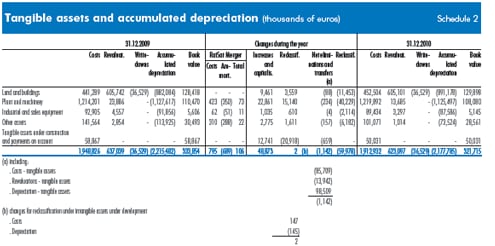

Tangible assets at 31 December 2010 amount to 321,715 thousand euros, showing an overall net decrease of 12,139 thousand

euros on 31 December 2009, comprising the balance between increases of 48,981 thousand euros (106 thousand of

which deriving from the merger of RaiSat) and decreases of 61,120 thousand euros, as detailed in Schedule 2.

Following authorisation by the Italian Ministry of Communications, the company may enlist the aid of subsidiaries for activities

relating to the performance of the pertinent services.

Rai's operations must be conducted in compliance with the applicable regulations in force contained in Law 103 of 14 April

1975 ("New regulations governing radio and television broadcasting"), Law 223 of 6 August 1990 ("Regulation of the public

and private radio and television system"), the "Measures governing the concession holder for the public radio and television

broadcasting service" issued with Law 206 of 25 June 1993 and subsequent amendments, Law 249 of 31 July 1997 on the

"Establishment of the Communications Authority and regulations governing telecommunications and the radio and television

system" and Law 112 of 3 May 2004 ("Regulations establishing principles for the organization of the radio and television

system and Rai-Radiotelevisione Italiana SpA, as well as granting authority to the Government to issue a consolidated radio

and television law"). With Legislative Decree 177 of 31 July 2005 approval was given to the" Consolidated Law governing

Radio and Television", which was amended and renamed "Consolidated Broadcasting Law" by Legislative Decree 44 of 15

March 2010, incorporating additional clauses, amendments and cancellations necessary for the co-ordination of the services

or their proper implementation. The Consolidated Law also contains the provisions of Law 112/04, relating to the radio and

television general public service and, consequently, articles 3 and 5 of Law 206/93 not repealed by Law 112/04.

The general public radio and television service concession is assigned to Rai until 6 May 2016, on the basis of the Consolidated

Law governing Radio and Television, issued with article 49 of the Legislative Decree 177 of 31 July 2005.

Article 45 of the same Consolidated Law envisages that the general public radio and television service be provided by the

concession holder on the basis of a National Service Agreement lasting three years, entered into with the Italian Ministry of

Communications, identifying the rights and obligations of the concession holder.

The new service agreement for 2010-2012 was entered into between the Ministry of Economic Development and Rai on 6

April 2011.

The rationale underlying the above regulatory framework lies in the public interest functions entrusted to the concession holder.

Under these regulations, Rai has special institutional characteristics and operating constraints, in addition to the specific obligations

undertaken with the Service Contract.

2) Introduction

The Parent Company financial statements at 31 December 2010 are prepared in accordance with the relevant provisions of

the Italian Civil Code. They are supplemented with annexes featuring the reclassified statements comprised of tables for the

analysis of the balance sheet and income statement, and of cash flows.

The financial statements are expressed in euros, without decimals; the Notes to the financial statements and the related detailed

Schedules are stated in thousands of euros.

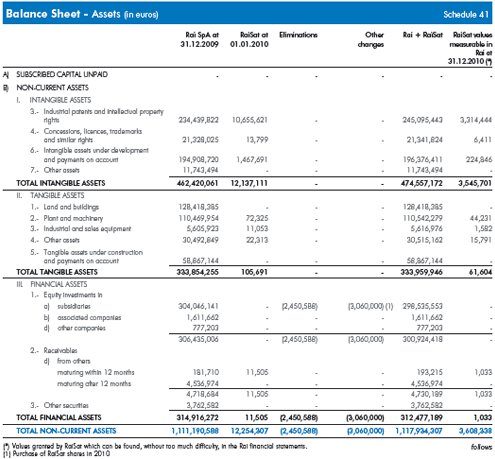

With regard to the merger by incorporation of RaiSat SpA, which took place during the year, detailed Schedules 41 and 42

have been drawn up to disclose the information required by legislation for the first financial statements following the merger.

Rai's financial statements have been audited by PricewaterhouseCoopers SpA.

3) Accounting policies

Before examining the individual items, we have provided an overview of the main accounting policies used in drafting the

financial statements, which were adopted from the perspective of the Company as a going concern and comply with the

provisions of Articles 2423 et seq. of the Civil Code. Such policies are unchanged from those applied in the preceding

year. There are no exceptional cases requiring derogation from the requirements under Article 2423-bis et seq. of the

Civil Code.

a) Industrial patents and intellectual property rights:

The acquisition and production costs of programmes, composed of external costs that can be allocated directly to each

project and the cost of internal resources used to create programmes, are recorded according to the following criteria:

1) costs for repeat-use television productions are capitalised under intangible assets and, if such productions are usable

at year-end, are carried under industrial patents and intellectual property rights and amortised on a straight-line basis

over the period of their estimated useful life. If such programmes are not yet usable at year-end, the costs are carried

under intangible assets under development and payments on account.

The objective difficulty of establishing an appropriate correlation between advertising revenues and licence fees and

the amortisation of the rights, which is further complicated by the many ways in which they can been used, has prompted

Rai to designate three years as the useful life of repeat-use programmes, represented by TV series, cartoons and

comedies, and four years for that of library exploitation rights for football events.

Costs for concession rights with a shorter duration are amortised over the period they are available.

In addition, an impairment provision has been established for programmes for which transmission or re-broadcasting

is at risk.

2) Costs for immediate-use television programmes are expensed in a single year, which is normally that in which they are

used. More specifically:

• News, light entertainment and all radio programming. Costs are expensed in the year in which they are incurred, which

is normally the year in which the programmes are broadcast.

• Sports events. Costs are booked to the year in which the event takes place.

•Documentaries, classical music and drama. Costs are charged against income in a single amount at the time the programmes

are ready for broadcasting or the rights are usable.

b) Software licences are carried with industrial patents and intellectual property rights net of amortisation and are amortized

over three years from the year they enter service.

c) Costs incurred for the construction of the digital terrestrial network are capitalised under intangible assets net of amortisation

and amortised on a straight-line basis over the forecast period of use from the date the service is activated.

d) Trademarks are amortized over ten years from the year they enter service.

e) Deferred charges are carried under other intangible assets net of accumulated amortisation. They regard improvements to

leased or licensed property and accessory charges on loans. Amortisation for leasehold improvements is determined on

the basis of the shorter of the residual duration of the related contracts and the estimated period of benefit of the costs, calculated

using amortisation rates which reflect the rate of economic deterioration of the relative assets. Accessory charges

on loans are amortised in relation to the duration of the loan.

f) Tangible fixed assets - which are shown net of accumulated depreciation - are recorded at cost, increased by internal

personnel costs incurred in preparing them to enter service, and revaluations pursuant to laws. The costs of fixed assets as

determined above are depreciated in accordance with Article 2426 (2) of the Civil Code. Ordinary maintenance costs are

expensed in the year in which they are incurred.

g) Equity investments are carried at purchase cost adjusted in the event of permanent impairment in value. The value of companies

with negative shareholders' equity is set at zero and Rai's share of the deficit is specifically provided for under the

provisions for risks and charges. Adjustments for permanent impairment are reversed in the event that such impairment is

subsequently recovered due to sufficient operating earnings by the investee company.

h) Fixed-income securities carried as non-current financial assets are valued at purchase cost. Positive or negative differences

between purchase cost and redemption value are taken to income in the amount accruing for the year.

i) Non-current assets which, at the balance sheet date, have suffered a permanent impairment in value, are carried at the

lower value. Should the reasons for the writedown made in previous years no longer apply, the assets are revalued within

the limits of the amount of the writedown.

j) Other securities carried under current financial assets are valued at the lower of purchase cost - determined as the

weighted average cost - and estimated realisable value, which is given by market value.

k) Inventories of raw materials, supplies and consumables (technical materials) are valued at purchase cost, which is determined

on the basis of weighted average cost, written down taking account of market trends and estimated non-use due to

obsolescence and slow turnover. Inventories of items for resale (relating to periodicals and book publishing) are carried at

the lower of purchase cost, which is determined on the basis of weighted average cost, and estimated realisable value as

determined by market prices.

l)Accrued income and prepaid expenses, and accrued expenses and deferred income, are recorded on an accruals basis

for the individual entries.

m) Provisions for pension and similar liabilities, which comprise the provision for supplementary staff severance pay, the social

security benefits provision and the company supplementary pension fund, are made in accordance with collective bargaining

agreements. The Company supplementary pension fund is valued on the basis of an actuarial appraisal.

n) The provision for taxes includes probable tax liabilities arising out of the settlement of tax disputes and includes deferred

tax liabilities calculated on timing differences which have resulted in lower current taxes. Deferred tax assets arising from

charges which are tax-deductible on a deferred basis and from tax losses are taken up under Current Assets caption 4 ter

("Deferred tax assets") if there is reasonable certainty that they will be recovered in the future.

o) Other provisions for risks and charges include provisions to cover specific losses or liabilities, the existence of which is

certain or probable, but the amount or date of occurrence of which is uncertain. They are set up on a case-by-case basis

in relation to specific risk positions and their amount is determined on the basis of reasonable estimates of the liability that

such positions could generate.

p) The provision for staff severance pay is determined in compliance with applicable law and labour contracts. It reflects the

accrued entitlement of all employees at the balance-sheet date net of advances already paid.

q) Payables are shown at nominal value; receivables are carried at estimated realisable value, net of bad debts provision as

determined on the basis of a case-by-case assessment of the solvency risks of the individual debtors.

r) Payables and receivables denominated in currencies other than the euro - with the exception of hedged positions,

which are valued at the rate applying to the financial instrument - are recorded at the exchange rates applying at

the balance sheet date. Profits and losses ensuing from such conversion are taken to the income statement as components

of financial income or expense. Any net profit is taken to a specific non-distributable reserve until the profit

is realised.

s) Payments on account include advances paid by customers for services that have not yet been performed.

t) Costs and revenues are taken to the income statement on a consistently applied accruals basis.

u) Dividends are taken to income in the year in which they are received.

v) Income taxes are recorded on the basis of an estimate of taxable income in conformity with applicable regulations, taking

account of deferred tax positions. The tax liability to be settled on presentation of the tax declaration is carried under taxes

payable, together with liabilities relating to taxes already assessed and due.

The Company has opted for the Group to be taxed on a consolidated basis and accordingly, as the consolidating entity,

attends to all requirements connected with the settlement of IRES tax for all companies within the consolidated taxation

arrangement.

The procedure for the consolidation of the Group's taxable amounts is regulated by a specific agreement between the

Parent Company and the subsidiaries.

The fundamental standards that regulate this agreement are neutrality (absence of negative effects on the single companies),

proportionality in the use of losses and their integral remuneration on the basis of the rate of IRES in force at the time

of effective use, offsetting the incomes booked.

w) In order to hedge interest rate and exchange rate risk, the Company uses derivative contracts to hedge net exposures arising

from specific transactions. Interest differentials to be collected or paid on interest rate swaps are taken to the income

statement on an accruals basis over the duration of the contract. Accrued interest differentials that have not been settled

at the end of the year or which have been settled before they actually accrue are taken to accrued income and prepaid

expenses, or accrued expenses and deferred income, as the case may be. Derivative contracts hedging exchange rate

risks are used to cover contractual commitments in foreign currencies and entail adjusting the value of the underlying item.

The premium or discount arising from the differential between the spot and future exchange rates for hedging transactions

carried out via future acquisition of value and premiums paid in relation to options is taken to the income statement over

the duration of the contract.

If the market value of derivatives contracts, which do not fully qualify for hedge accounting, is negative, a specific risk

provision is set up for this value.

x) Collections are recorded by bank transaction date; for payments account is likewise taken of the instruction date.

4) Parent Company balance sheet

Assets

Non-current assets

Intangible assets

This caption includes the cost of non-physical factors of production with lasting utility, net of amortisation and writedowns

in the event of permanent impairment of value.

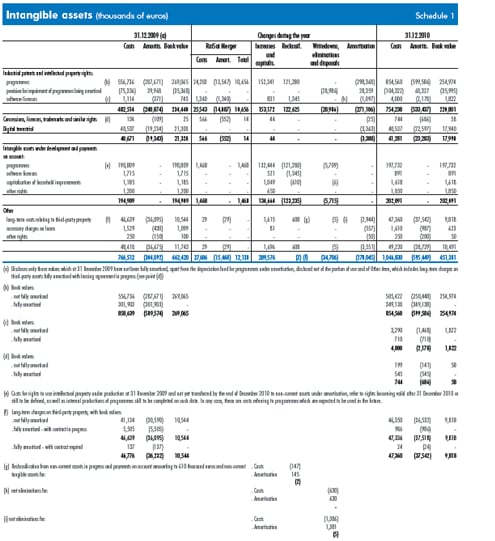

Industrial patents and intellectual property rights. As indicated in Schedule 1, they amount to 220,801 thousand euros,

as follows:

• 218,979 thousand euros for the cost of television programmes available for use, and compared with the figure as at 31

December 2009, shows a net decrease of 14,718 thousand euros. This decrease is represented by the balance between

the increase determined by the merger by incorporation of RaiSat (10,656 thousand euros), new assets for 273,621 thousand

euros (of which 121,280 thousand euros transferred from non-current assets under development and payments on

account for rights that became available during the year), a writedown against the risk of non-transmission and/or repeatability

of certain programmes amounting to 28,986 thousand euros and the amortisation charge for the year of 270,009

thousand euros;

• 1,822 thousand euros refers to software licences, which amounted to 743 thousand euros as at 31 December 2009.

This value is represented by the balance between new assets for 2,176 thousand euros (of which 1,345 thousand euros

transferred from non-current assets under development and payments on account for products that became available during

the year) and the amortisation charge for the year of 1,097 thousand euros.

As regards television programmes available for use, the overall sum, gross of the writedown, is broken down between:

• rights to television programmes owned or held under unlimited-term licences amounting to 218,500 thousand euros (at

31 December 2009: 221,868 thousand euros);

• rights to television programmes owned or held under fixed-term licences amounting to 36,474 thousand euros (at 31

December 2009: 47,197 thousand euros).

Overall investments in television programmes made in 2010 amount to 284,785 thousand euros, including 132,444 thousand

euros in programmes which are not yet available at 31 December 2010, which are carried under non-current assets

under development and payments on account.

Analysing investments by type, at 31 December 2010, 235,852 thousand euros was invested in fiction programmes (series,

miniseries, TV movies, soap operas etc), 11,774 thousand euros in documentaries, 17,444 thousand euros in cartoons and

comedy programmes, 10,150 thousand euros in football libraries and 9,565 thousand euros in other categories.

Concessions, licences, trademarks and similar rights. The items, which is stated net of accumulated amortisation, includes

costs incurred on the acquisition of licences for digital terrestrial frequencies, and own trademarks. They total 17,998

thousand euros, of which 17,940 thousand euros relating to digital network frequencies.

Non-current assets under development and payments on account. The item amounts to 202,091 thousand euros,

including:

• 197,732 thousand euros for the cost of television programmes which are not yet available, and therefore not subject to

amortisation, and compared with the figure as at 31 December 2009, showing a net increase of 6,923 thousand euros,

as indicated in Schedule 1. Specifically, the aforementioned increase is represented by the balance between the increase

determined by the merger by incorporation of RaiSat (1,468 thousand euros), increases for new assets (132,444 thousand

euros) and decreases for items transferred to Industrial patents and intellectual property rights in that they relate to productions

and/or purchases which became usable during the year (121,280 thousand euros) and eliminations for 5,709

thousand euros;

• 891 thousand euros refers to software licences and, compared with the figure as at 31 December 2009, shows a net

reduction of 824 thousand euros. The aforementioned increase is equal to the balance between increases for new assets

(521 thousand euros) and decreases for items transferred to Industrial patents and intellectual property rights in that they

relate to products that became usable during the year (1,345 thousand euros);

• 1,850 thousand euros refers to the cost to purchase options on agreements for the commercial exploitation of products held

in football libraries and, compared with the figure as at 31 December 2009, with a net increase of 650 thousand euros;

• 1,618 thousand euros refers to alterations and improvements underway on property under leasehold or concession and,

compared with the figure as at 31 December 2009, shows a net increase of 433 thousand euros;

For television programmes that have not yet become available, the total of 197,732 thousand euros includes:

• 151,957 thousand euros for television programmes owned by the Company that were not ready at 31 December 2010

or for which usage rights began after 31 December 2010 (at 31 December 2009: 150,767 thousand euros);

• 45,775 thousand euros regarding third-party television programmes held on fixed-term licence beginning after 31

December 2010 (at 31 December 2009: 40,042 thousand euros).

Other intangible assets. The amount of 10,491 thousand euros includes:

• 9,818 thousand euros for costs incurred, net of accumulated amortisation, on alterations and improvements to property

under leasehold or concession (at 31 December 2009: 10,544 thousand euros);

• 623 thousand euros for costs incurred during the year, net of accumulated amortisation, on stand-by loans with a duration

of three years, to be broken down throughout the loan period (at 31 December 2009: 1,099 thousand euros);

• 50 thousand euros for the purchase of a right to the first negotiation and option on the broadcasting of football matches,

net of amortisation calculated over the concession period (at 31 December 2009: 100 thousand euros).

Tangible assets

These comprise the costs and related revaluations of tangible fixed assets with a useful life of several years that are owned by the

Company and used in operations. They are carried net of standard depreciation and writedowns for lasting value impairments if any.

The standard depreciation rates applied are listed below:

• Buildings and light structures

- offices in industrial buildings

3%

- other industrial buildings and roads

6%

- light structures

10%

• Plant and machinery

- general and radio technical plant

12,5%

- transmission and television plant

19%

- recording plant and fitted vehicles

25%

• Industrial and sales equipment

19%

• Other assets:

- standard equipment

19%

- office furniture and equipment

12%

- electronic office equipment

20%

- transport vehicles

20%

- motor cars, motor vehicles and the like

25%

It should be noted that new tangible assets recorded, which reflect investments made in the year, comprise 5,924 thousand

euros for the capitalisation of the cost of internal personnel engaged in the construction of buildings, plant and machinery.

As regards disclosure of financial lease transactions it should be noted that since 2004 only the building located in Aosta was

acquired under this type of contract, to serve as the regional headquarters for Valle d'Aosta. The statements required under article

2427 (22) of the Civil Code, referred to in Document 1 of the Organismo Italiano di Contabilità (Italian Accounting Board),

showing the effects on the balance sheet and the income statement of the so-called financial method, are presented hereunder.

The gross value of revaluations recorded under non-current tangible assets is reported below, listed according to the applicable

regulations:

• 45,153 thousand euros gross in implementation of Law 576 of 2 December 1975 and Law 72 of 19 March 1983, the

purchase cost of which was 55,979 thousand euros. This comprises property acquired by 31 December 1946, the gross

value of which, amounting to 430 thousand euros, includes revaluation pursuant to Law 74 of 11 February 1952;

• 57,010 thousand euros gross in implementation of Law 413 of 30 December 1991;

• 520,934 thousand euros gross in implementation of Decree Law 263 of 29 April 1994, the effects of which were ratified

by Law 650 of 23 December 1996.

Non-current financial assets

These represent the cost of durable financial investments and related revaluations, net of any writedowns described in the

comments on the individual items.

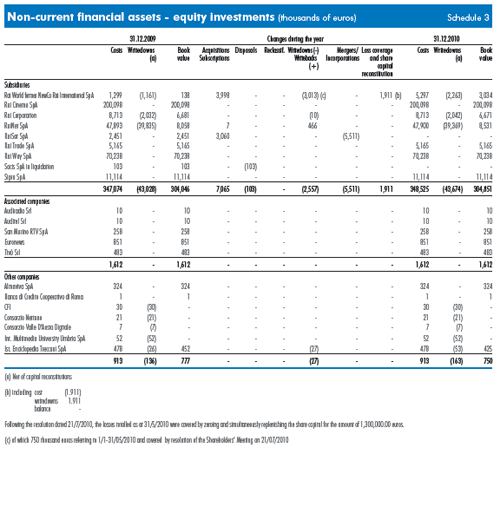

Equity investments: these amount to 307,213 thousand euros and include investments in shares or other forms of equity in

companies, including consortiums. They are reported in the balance sheet under separate headings arranged by decreasing

levels of ownership.

The components of the value of equity investments, their distribution among the individual investee companies and transactions

during the period are detailed in Schedule 3. Schedule 4 shows the list of investments in subsidiaries and associated

companies pursuant to article 2427, item 5, of the Civil Code.

The following section discusses the more significant developments in investee companies and the consequent impact on the

Rai financial statements:

Equity investments in subsidiaries

•Rai World SpA formerly NewCo Rai International SpA (99.954% Rai): the share capital of 1,300 thousand euros is

represented by 1,300,000 shares with a par value of 1 euro each. The extraordinary shareholders' meeting held on

22 July 2010 resolved the coverage of the losses totalled at 31 May 2010 amounting to 1,911,840.66 euros, with the

zeroing of the share capital of 1,300,000 euros and payment by the shareholders, in proportion to the shares owned

until then, of the additional sum of 611,840.66 euros. At the same time, the replenishment and increase of the capital

to the amount of 1,300,000 euros was resolved, with the issue of 1,300,000 new shares with a par value of 1 euro

each. Rai subscribed to these shares for a total of 1,299,402 euros, with the remaining 598 euros worth of shares

going to Rai Trade. During the meeting held on 21 July 2010, Rai's Board of Directors resolved the performance of an

intervention on the capital in favour of the company, amounting to 3,410,271.21 euros, of which 1,910,961.21 for the

replenishment of the capital, as mentioned earlier, and 1,499,310 euros for future capital increase. This last payment

was made on 15 September 2010, with Rai Trade also participating with the amount of 690 euros. During the meeting

held on 22 December 2010, Rai's Board of Directors resolved a further payment for future capital increase, totalling

2,500,000 euros, to be made by both shareholders in their respective percentages, with said amount to be deposited

on the corresponding current account, available from 22 December 2010. The company ended 2010 with a loss of

3,014 thousand euros, 750 thousand euros of which has already been covered. For the remainder, the value of the

shareholding was written down accordingly.

•Rai Cinema SpA (99.997678% Rai): the share capital of 200,000 thousand euros is represented by 38,759,690 shares

with a par value of 5.16 euros each. During 2010, the company paid a dividend for 2009 of 38,760 thousand euros,

which Rai recorded under Income from equity investments in the amount pertaining to it. 2010 ended with a net profit of

58,745 thousand euros.

• Rai Corporation (100% Rai): the share capital of 500,000 thousand US$ is represented by 50,000 shares with a par

value of 10 US$ each. The holding is carried at a gross value of 8,713 thousand euros in that this includes the payment

on account of share capital of US$ 10,000,000 which was made during 2005. At 31 December 2010 the value of the

holding, already written down at 31 December 2009 for 2,032 thousand euros, was further written down for 11 thousand

euros to adjust it to the equity held in the company, at the exchange rate in force on 31 December 2010.

• RaiNet SpA (100% Rai): the share capital of 5,160 thousand euros is represented by 1,000,000 shares with a par value

of 5.16 euros each. On 28 September 2010 Rai Trade sold its shares to Rai, which gained full control of the company.

During the first half of 2010, the company paid a dividend for 2009 of 1,000 thousand euros, which Rai recorded under

Income from equity investments in the amount pertaining to it, equal to 999 thousand euros. At 31 December 2010 the

gross value of the holding amounting to 47,900 thousand euros, which had been written down at 31 December 2009 by

39,835 thousand euros, was revalued by 466 thousand euros in view of the profit earned by the company in 2010.

• RaiSat SpA (100% Rai): with an agreement entered into on 18 March 2010, Rai purchased from RCS MediaGroup SpA

the entire shareholding, increasing its share by 5%. Furthermore, on 29 April 2010, Rai Trade sold its shares to Rai, which

gained full control of the company in view of the merger by incorporation resolved by the respective boards. With the

deed of merger dated 23 September 2010, the resolution of the Board of Directors of Rai, passed in the meeting held on

7 July 2010, and the resolution of the Extraordinary Shareholders' Meeting of RaiSat SpA, passed on 9 July 2010, were

implemented, proceeding with the merger of the two companies by incorporation of RaiSat SpA into Rai-Radiotelevisione

Italiana SpA on the basis of the respective financial statements as at 31 December 2009, effective in economic and fiscal

terms from 1 January 2010.

•Rai Trade SpA (100% Rai): the share capital of 8,000 thousand euros is represented by 100,000 shares with a par value

of 80 euros each. The company ended 2010 with a profit of 2,707 thousand euros. During 2010 it paid a dividend of

2,300 thousand euros on the result for 2009, which was taken to Income from equity investments.

• Rai Way SpA (99.99926% Rai): the share capital of 70,176 thousand euros is represented by 13,600,000 shares with

a par value of 5.16 euros each. The company ended 2010 with a profit of 22,119 thousand euros. During 2010, the

company paid a dividend for 2009 of 14,144 thousand euros, which Rai recorded under Income from equity investments

in the amount pertaining to it.

• Sacis SpA in liquidation (100% Rai): the company, which has been in liquidation since 23 January 1998, has completed its

winding up and, on 22 November 2010, the Shareholders' Meeting approved the Final financial statements for liquidation

purposes and the Distribution Plan, resolving cancellation of the Company from the Register of Companies. The write-off

of the shareholding against the company's equity resulted in a capital gain taken to Income from equity investments for

the amount of 4,764 thousand euros.

• Sipra SpA (100% Rai): the share capital of 10,000 thousand euros is represented by 100,000 shares with a par value of

100 euros each. The company ended 2010 with a profit of 4,247 thousand euros. During 2010 it paid a dividend of

1,400 thousand euros on the result for 2009, which was taken to Income from equity investments.

Equity investments in associated companies

• Audiradio Srl (30.23% Rai): the company's last approved financial statements date back to 31 December 2009. On said

date, the share capital amounted to 258 thousand euros and consisted of 258,000 quotas with a par value of 1 euro

each. In January 2011, Rai sold part of the quotas held. Consequently, the share owned fell from 30.23% to 27%, in

compliance with the resolution passed by Rai's Board of Directors on 17 November 2010.

• Auditel Srl (33% Rai): the company ended 2010 with a profit of 7 thousand euros. The quota capital of 300 thousand

euros is represented by 300,000 quotas with a par value of 1 euro each.

• San Marino Rtv SpA (50% Rai): this company was established in 1991 by Rai and E.RA.S. - Ente di Radiodiffusione

Sammarinese with an equal holding in the company. It was set up pursuant to Law 99 of 9 April 1990 ratifying the collaboration

treaty between the Republic of Italy and the Republic of San Marino concerning radio and television. It closed

2010 with a loss of 51 thousand euros. The share capital of 516 thousand euros is represented by 1,000 shares with a

par value of 516.46 euros each.

•Euronews - Sociètè Anonyme (22.84% Rai) : The share capital of 3,631 thousand euros is represented by 242,039 shares

with a par value of 15 euros each. The company ended 2010 with a profit of 1,389 thousand euros. During the same

period it paid a dividend of 182 thousand euros relating to the 2009 result, of which 41 thousand euros pertained to Rai,

which was taken to Income from equity investments.

• Tivù S.r.l. (48.16% Rai): the company ended 2010 with a profit of 1,033 thousand euros. On 23 April 2010, the entry of

new quotaholders through an increase in capital was resolved. The quota capital of 1,001 thousand euros was subscribed

by Rai and by R.T.I. - Reti Televisive Italiane S.p.a. - with equal holdings of 48.16%, by TI Media - Telecom Italia Media

S.p.a. - with a share of 3.5% and by two associations - FRT and Aeranti Corallo - each with a 0.09% share.

Equity investments in other companies

•Almaviva - The Italian Innovation Company SpA (1.201% Rai): the value of the holding is unchanged from 2009, amounting

to 324 thousand euros. The share capital is represented by 107,567,301 ordinary shares with a par value of 1.00

euro each.

• Banca di Credito Cooperativo di Roma S.c.p.a. (variable capital company; insignificant percentage held by Rai): carried

at a value of 1 thousand euros, equivalent to that paid on 16 January 2009 for the purchase of 100 shares.

• C.F.I - Consorzio per la Formazione Internazionale (consortium for international education): the investment, which was carried

at the value of the share in the consortium paid in upon joining, 30 thousand euros, has been fully written off since,

under the bylaws of the consortium, withdrawal does not entitle members to reimbursement of their contribution.

• Consorzio Nettuno - Consorzio per la realizzazione di università a distanza (consortium for the distance learning university):

the investment of 21 thousand euros has been fully written off since, under the bylaws of the consortium, withdrawal does

not entitle members to reimbursement of their contribution.

• Consorzio Valle d'Aosta Digitale in liquidazione - Consortium for the switchover from analogue to DTT in the Valle d'Aosta

region. The company, was put into liquidation by deed on 23 December 2010. The investment of 7 thousand euros has

been fully written off since, under the bylaws of the consortium, withdrawal does not entitle members to reimbursement of

their contribution.

• International Multimedia University Umbria SpA (1.533% Rai): the investment has been fully written off since there is no

longer any certainty that the amounts paid in can be recovered.

• Istituto Enciclopedia Treccani SpA (0.83% Rai): the investment, carried at a gross value of 478 thousand euros, already

written down at 31 December 2009 by 26 thousand euros, was adjusted again by 27 thousand euros to adapt the value

of the investment to the company's equity. The share capital is represented by 750,000 shares with a par value of 51.65

euros each.

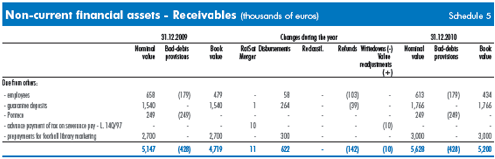

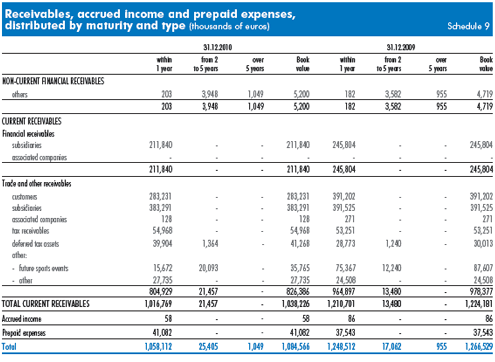

Receivables: these are booked, as highlighted in Schedule 5, for the amount of 5,200 thousand euros (at 31 December

2009: 4,719 thousand euros). They consist of 3,000 thousand euros of payments on account for mandates to sell rights for

the production and distribution of initiatives regarding archive materials of football clubs, 1,766 thousand euros for cautionary

deposits and 434 thousand euros for loans to employees. Schedule 9 details their distribution by maturity and Schedule

10 by geographic area.

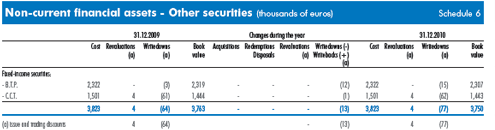

Other securities these are carried at 3,750 thousand euros and relate entirely to securities pledged as collateral; details

thereof are given in Schedule 6.

Current assets

Inventories

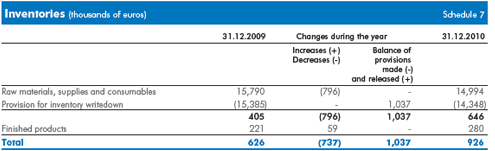

Inventories amount to 926 thousand euros net of the inventory provision (at 31 December 2009: 626 thousand euros). As

shown in Schedule 7, they comprise:

• Raw materials, supplies and consumables: these amount to 646 thousand euros net of the write-down provision for 14,348

thousand euros. They consist entirely of supplies and spare parts for maintenance and the operation of equipment, considered

as consumables since they are not directly incorporated into products.

• Finished goods and merchandise: these consist entirely of inventories associated with the publishing business of books and

periodicals, amounting to 280 thousand euros net of a writedown of 751 thousand euros to bring them into line with their

estimated realisable value.

Receivables

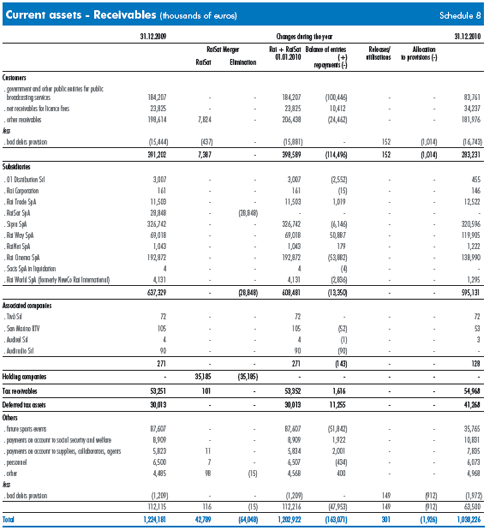

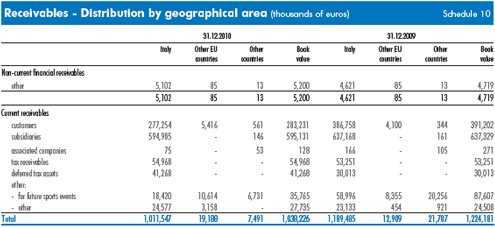

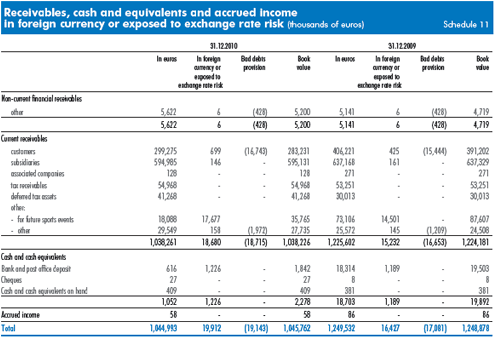

Receivables total 1,038,226 thousand euros, showing a decrease of 185,955 thousand euros on 31 December 2009, as

can be seen in Schedule 8, which gives a breakdown of receivables, components of value and the contribution deriving from

the merger with RaiSat SpA, and in Schedules 9 and 11 which show their distribution by maturity, type and by currency. Their

distribution by geographic area is shown in Schedule 10.

Receivables from customers: these relate to trade receivables, excluding those from subsidiaries and associated companies,

which are carried under separate headings. They total 283,231 thousand euros, with a nominal value of 299,974 thousand

euros which has been written down by 16,743 thousand euros to bring them to their estimated realisable value. Compared

with 31 December 2009, they show a decrease of 107,971 thousand euros.

Details of the caption are divided into:

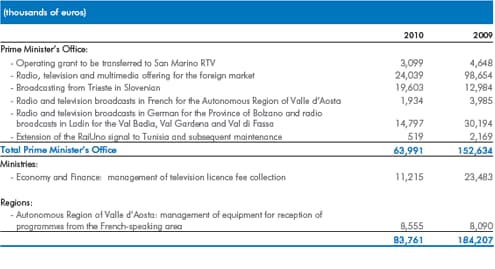

• receivables for public broadcasting services to central government and other public entities: as shown in the following table,

these amount to a nominal 83,761 thousand euros, down 100,446 thousand euros on 31 December 2009, equivalent

to the balance between the increase in invoices issued and for amounts accrued for 2010 less collections.

The following should be noted in connection with the above receivables:

- Prime Minister's Office: receivables for television, radio and multimedia broadcasts abroad in Slovenian, French, German

and Ladin relate to services rendered in 2010;

- Ministry for the Economy and Finance: in relation to the management of television licence fee collection, the receivable

refers only to 2010;

- Autonomous Region of Valle d'Aosta: the receivable of 8,555 thousand euros relates to the reimbursement of costs

incurred for the operation of equipment for the reception of French-language programmes for the years from 1994 to

2010.

• Net receivables for licence fees: these amount to 34,237 thousand euros, up 10,412 thousand euros on 31 December

2009, representing licence fees not yet transferred to Rai. Activities are underway to recover such receivables. They consist

in asking the Ministry of the Economy and Finance to increase the specific provision of the expense section during the

settlement of the Government Financial Statements for 2011, in order to allow recovery, with liquidation of the fourth

instalment of transfer of the fees, envisaged to take place in December 2011.

• Other receivables: these amount to nominal value 181,976 thousand euros, down 16,638 thousand euros on 31

December 2009. They relate to the sale of rights, technical assistance to third parties etc..

Receivables from subsidiaries: these amount to 595,131 thousand euros (at 31 December 2009: 637,329 thousand

euros). They represent the year-end balance of transactions with subsidiaries, as shown in Schedule 8. They include financial

receivables of 211,840 thousand euros (245,804 thousand euros at 31 December 2009) and non-financial receivables of

383,291 thousand euros (391,525 thousand euros at 31 December 2009).

Receivables from associated companies: these amount to 128 thousand euros (at 31 December 2009: 271 thousand

euros) and represent the balance of non-financial transactions with Tivù (72 thousand euros), San Marino Rtv (53 thousand

euros) and Auditel (3 thousand euros).

Tax receivables: these are carried at nominal value of 54,968 thousand euros (53,251 thousand euros at 31 December

2009). They comprise 46,144 thousand euros for the balance of Group VAT credits, 6,560 thousand euros for tax refunds

requested (including credit for IRES following the introduction of law which made the IRAP paid during previous tax years partly

deductible), credit for IRAP for the year of 2,141 thousand euros and the remainder relating to minor items.

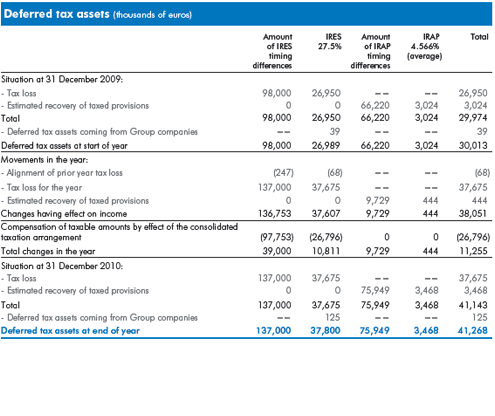

Deferred tax assets: these total 41,268 thousand euros and represent the credit deriving from items subject to deferred

deductibility for tax purposes, as explained more fully in the section dealing with income taxes, for 41,143 thousand euros, in

addition to which there are items transferred from Group companies participating in the consolidated taxation arrangement.

Details of deferred tax assets, regarding movements in 2010, are provided in the following table:

Receivables from others: these amount to 63,500 thousand euros (at 31 December 2009: 112,115 thousand euros). Net

of writedowns of 1,972 thousand euros, they reflect the value of other types of receivable as described below:

• advances to suppliers on sports events filming rights, carried at nominal value of 35,765 thousand euros;

• advances to Social Security institutions on contributions payable for artistic activities and advances on the severance pay,

carried at nominal value of 10,831 thousand euros;

• miscellaneous advances to suppliers carried at nominal value of 7,835 thousand euros;

• receivables from personnel carried at nominal 6,073 thousand euros. They are entirely composed of advances of various

types, mainly for travel expenses (2,371 thousand euros) and production expenses (1,396 thousand euros);

• receivables from the European Union for subsidies and grants for nominal 422 thousand euros, consisting entirely of

receivables for research projects;

• receivables from others, carried at nominal value of 4,546 thousand euros.

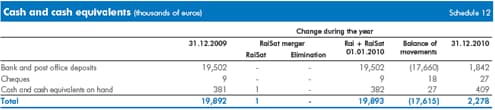

Cash and cash equivalents

These are listed in Schedule 12 and comprise:

• Bank and post office deposits: these amount to 1,842 thousand euros (at 31 December 2009: 19,502 thousand euros).

They represent sight or short-term balances on deposit or current account with banks, financial institutions and the Post

Office.

• Cheques: these amount to 27 thousand euros (at 31 December 2009: 9 thousand euros).

• Cash and cash equivalents on hand: these amount to 409 thousand euros (at 31 December 2009: 381 thousand euros)

and include liquid funds in the form of cash and equivalent instruments (duty stamps, cashier's cheques or bank-guaranteed

cheques etc.) held by the Company at 31 December 2010.

Schedule 11 gives a breakdown of the caption in euros and other currencies and Schedule 24 shows amounts at banks and

the Post Office held with Group companies and restricted by attachments.

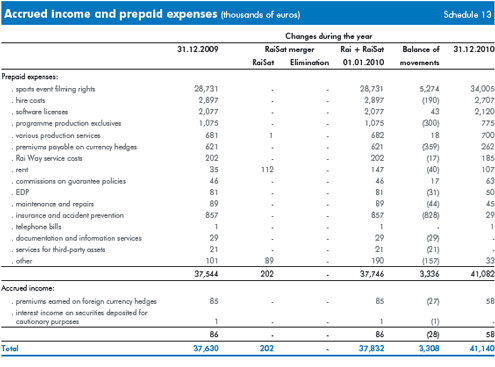

Accrued income and prepaid expenses

Accrued income and prepaid expenses total 41,140 thousand euros. They are detailed in Schedule 13.

Liabilities

Shareholders' equity

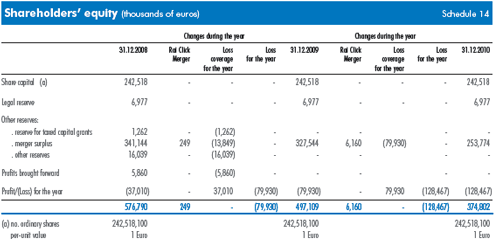

Shareholders' equity totals 374,802 thousand euros.

The components of Shareholders' equity and the effects of operations carried out in 2010 and the previous year are shown

in Schedule 14.

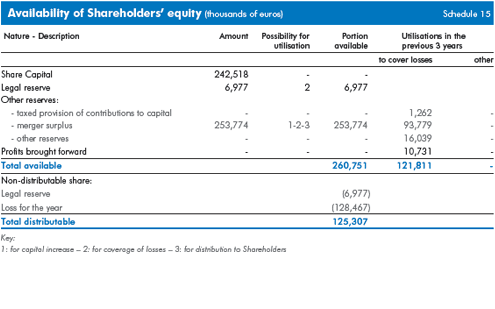

Schedule 15 presents the classification of the Shareholders' equity items on the basis of their origin, possibility of use and

distribution, as well as their use during the previous three years.

The notes indicated hereunder provide further details on the contents of the individual items.

Share Capital

At 31 December 2010 the share capital was represented by 242,518,100 ordinary shares with a par value 1 euro each,

owned by the Ministry of the Economy and Finance (241,447,000 shares, equal to 99.5583% of the share capital) and SIAE,

the Italian Association of Authors and Publishers (1,071,100 shares, equal to 0.4417% of share capital).

Legal Reserve

The legal reserve amounts to 6,977 thousand euros.

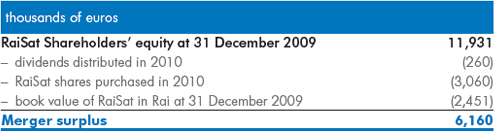

Other reserves

Other reserves total 253,774 thousand euros which refer entirely to the merger surplus. The merger by incorporation of RaiSat

determined the booking of a merger surplus of 6,160 thousand euros, broken down as follows:

Loss for the year

This amounts to 128,467,320.38 euros.

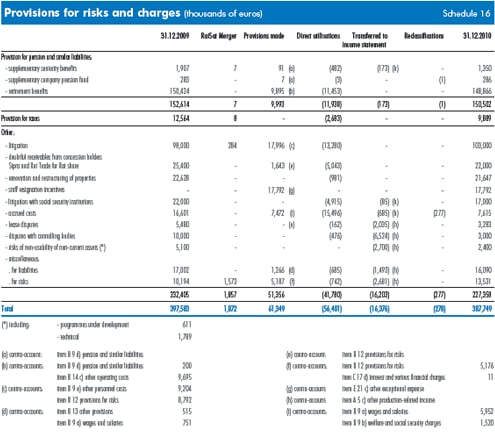

Provisions for risks and charges

These amount to 387,749 thousand euros, down 9,834 thousand euros net on 31 December 2009. The composition of

these items and details of the decrease are shown in Schedule 16. The notes which follow provide additional information on

the individual provisions.

Provision for pension and similar liabilities: this amounts to 150,502 thousand euros and comprises the supplementary

seniority benefits provision, the retirement benefits provision and the company supplementary pension fund.

• The provision for supplementary seniority benefits amounts to 1,350 thousand euros (at 31 December 2009: 1,907

thousand euros). It represents the liability in respect of indemnities in lieu of notice towards employees hired before 1978

who have reached the compulsory retirement age. The amount is revalued each year for consumer price inflation. In the

event of early termination of employment, or changes in category, the amounts accrued are released.

• The provision for retirement benefits amounts to 286 thousand euros (at 31 December 2009: 283 thousand euros),

includes amounts accrued until 31 December 1988 and supplementary amounts allocated in subsequent periods in order

to protect the real value of the provision for eligible employees in accordance with the terms of the national collective

labour agreement.

Since 1 January 1989 retirement benefits paid by Rai and withholdings from employees have been paid into CRAIPI (supplementary

retirement fund for Rai employees) and FIPDRAI (supplementary retirement fund for Rai managers), associations

which are responsible for managing retirement funds under the agreements entered into between Rai and the trade unions.

Upon retirement, the funds accumulated by Rai, CRAIPI and FIPDRAI are paid out unless employees opt, at the time they

obtain the pension rights, to obtain equivalent life annuities. In this case, the Rai, FIPDRAI and CRAIPI funds remain with

the associations to finance the said life annuities.

• The provision for supplementary seniority benefits amounts to 148,866 thousand euros (at 31 December 2009: 150,424

thousand euros). It includes:

- 139,638 thousand euros for supplementary pension benefits currently being paid (at 31 December 2009: 141,396

thousand euros) consisting of funds accrued for employees who have opted for the supplementary pension plan under

the trade union agreements, which are kept at an adequate level to ensure said benefits, with respect to actuarial

reserves;

- 9,228 thousand euros (at 31 December 2009: 9,028 thousand euros) for supplementary pensions that will be paid to

eligible managerial staff still in service in the event that some of these opt for the supplementary pension plan. Benefits are

calculated on the basis of pay earned, seniority and financial and demographic parameters normally used in similar cases.

The provision for current and deferred taxes amounts to 9,889 thousand euros (at 31 December 2009: 12,564 thousand

euros). The following table shows a breakdown of the item and changes during 2010.

Other provisions: these amount to 227,358 thousand euros (at 31 December 2009: 232,405 thousand euros). They include

provisions for costs or losses the existence of which is certain but the amount of which cannot be exactly determined, or

which are probable and the amount of which can be reasonably estimated. The main items are detailed in Schedule 16. As

regards pending litigation with employees and third parties, the amount carried in the provisions for liabilities and risks is the

best estimate of the likely liability based on the most up-to-date information available.

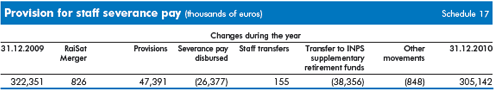

Provision for staff severance pay

The provision totals 305,142 thousand euros (at 31 December 2009: 322,351 thousand euros). The provision for staff

severance pay is determined at individual level in accordance with the provisions of art. 2120 of the Italian Civil Code,

complemented by the Finance Law 2007 (Law 296 of 27 December 2006), which established the entry into force of the new

legislation on pension funds (Legislative Decree 252 of 5 December 2005) as 1 January 2007.

By effect of this legislation, provisions for staff severance pay converge into pension funds other than those inside the company,

unless employees ask to maintain the severance pay within the company: In this case, the provisions are paid into a reserve

managed by the INPS, which will transfer to the company all the benefits disbursed by the latter in the event of payment of

advances or termination of the employment contract, as envisaged by Article 2120 of the Civil Code.

The composition of the provision and changes during the year are shown in Schedule 17.

Payables

These amount to 1,055,463 thousand euros, down 67,424 thousand euros on 31 December 2009.

More specifically, financial debt to banks totals 147,979 thousand euros, with a net decrease of 15,755 thousand euros on

the figure disclosed in the 2009 financial statements. No payables covered by collateral in the form of company assets are

recorded.

A breakdown of the caption and the contribution deriving from the merger with RaiSat is given in Schedule 18, while Schedules

19 and 20 show the composition of payables by maturity, type and currency.

With regard to geographic distribution, about 86% relates to Italian residents and about 12% relates to non-EU residents.

The notes indicated hereunder provide further details on the contents of the individual items.

Due to banks: these amount to 147,979 thousand euros (at 31 December 2009: 163,734 thousand euros), representing

the negative balance of current account overdrafts with certain banks.

Advances: these amount to 747 thousand euros (at 31 December 2009: 990 thousand euros) relating entirely to miscellaneous

advances.

Due to suppliers: amounts to 557,103 thousand euros (at 31 December 2009: 537,616 thousand euros) and shows an increase

of 19,487 thousand euros with respect to the figure disclosed for the previous year. They consist of 123 thousand euros

in financial debts (unchanged from 31 December 2009) and 556,980 thousand euros in commercial debts (31 December

2009: 537,493 thousand euros).

Accounts payable to subsidiaries: amount to 166,657 thousand euros (at 31 December 2009: 203,307 thousand euros),

as detailed in Schedule 18. They include financial debt for 60,676 thousand euros (at 31 December 2009: 49,184 thousand

euros) and non-financial payables of 105,981 thousand euros (at 31 December 2009: 154,123 thousand euros).

Accounts payable to associated companies: amount to 5,646 thousand euros (at 31 December 2009: 5,500 thousand

euros), as detailed in Schedule 18. They include financial debt for 1,560 thousand euros (at 31 December 2009: 146 thousand

euros) and non-financial payables of 4,086 thousand euros (at 31 December 2009: 5,354 thousand euros).

Taxes payable: these amount to 71,806 thousand euros (at 31 December 2009: 60,291 thousand euros) and show an

increase of 11,515 thousand euros with respect to the figure disclosed for the previous year. They consist of:

As regards debt in relation to IRES, as reported in the accounting policies, the company has opted for group taxation, transferring

to itself, as the consolidating entity, the activities inherent in the liquidation and payment of the tax with regard to the

following companies: 01 Distribution, Rai World (formerly NewCo Rai International), Rai Cinema, Rai Way, RaiNet, Sipra and

Rai Trade, within the consolidated taxation arrangement. For 01 Distribution, Rai World (formerly NewCo Rai International),

Rai Cinema, Rai Way and RaiNet the entitlement to make use of the consolidation tax arrangement has been renewed until

financial year 2012; for Sipra, for which the last financial year available for use of this arrangement is 2010, the option will

be renewed until 2013 within the terms envisaged.

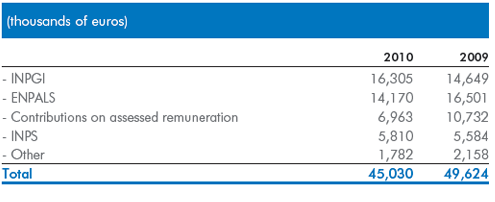

Welfare and social security institutions: these payables amount to 45,030 thousand euros (at 31 December 2009: 49,624

thousand euros). They reflect contributions due on remuneration paid to employees and consultants, to be paid over to the

institutions at the scheduled dates. They consist of:

Other payables: these amount to 60,495 thousand euros (at 31 December 2009: 101,825 thousand euros), and show a

net decrease of 41,330 thousand euros on the previous year, as follows:

Accrued expenses and deferred income

This caption totals 48,673 thousand euros. Details and a comparison with the previous year are provided in Schedule 21.

The caption contains the entire amount contributed of 46,758 thousand euros, net of the amount already booked to the

income statement, disbursed by the Ministry for Communications in support of initiatives to accelerate the switch-over to the

digital terrestrial platform, consisting of operations on systems and adaptation of the site infrastructures to extend areas covered

by the digital signal and improve reception and the quality of service perceived by the user.

The task of making the necessary investments is entrusted to the subsidiary Rai Way SpA, which is also responsible for the

design, installation, construction, maintenance, implementation, development and operation of the telecommunications networks.

The contribution is disclosed in the income statement of each year in relation to amortisation booked by the subsidiary, taking

into account the relationship between the amount of contributions collected and the total investments envisaged for the

accomplishment of related projects.

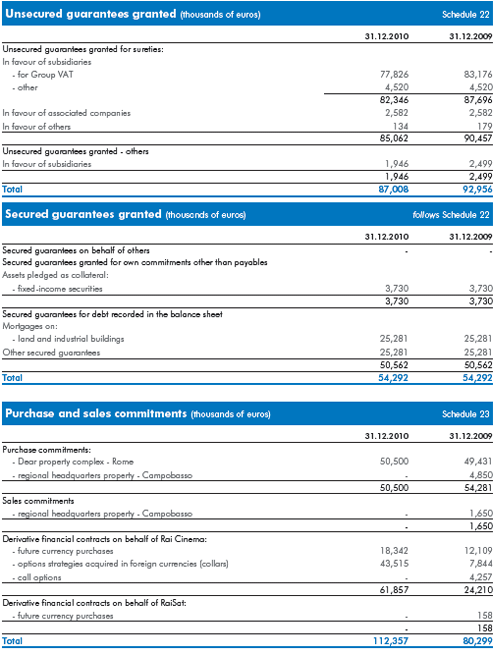

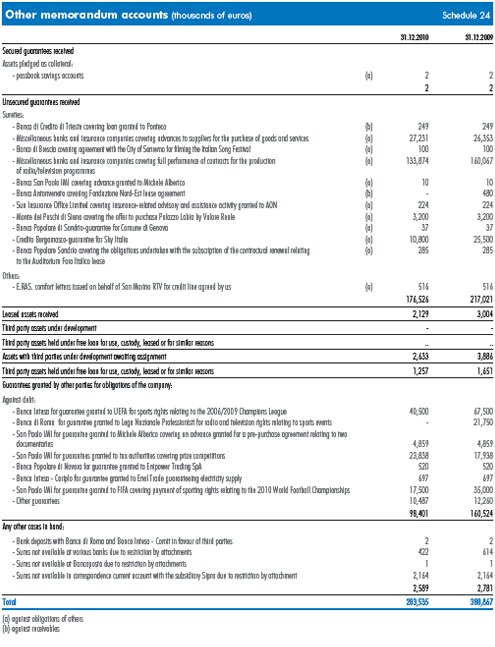

5) Memorandum accounts

Memorandum accounts amount to 537,193 thousand euros. A breakdown by type is provided in the table attached to the

Parent Company balance sheet and they are analysed in detail in Schedules 22, 23 and 24.

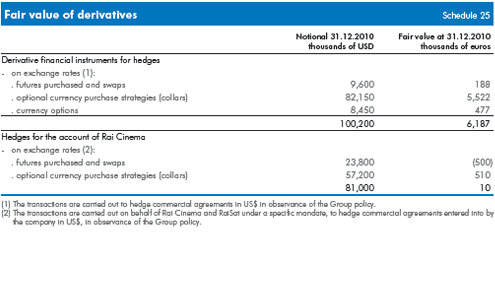

The terms of the hedge contracts covering the specific company commitments or those taken on for the subsidiary Rai Cinema

SpA relating to fair value are summarised in Schedule 25. The fair value of these instruments is determined with reference to

the market value on the closing date of the period under assessment; in the case of unlisted instruments, fair value is determined

using commonly used financial evaluation techniques.

On the whole, hedging contracts entered into are, in observance of the Group policy, of a reasonable amount in relation to

the overall extent of the commitments subject to such risks.

The purchase commitments also include the DEAR property complex, with a value of 50,500 thousand euros, transferred in 2011.

At 31 December 2010 there were no commitments, other than those highlighted among the memorandum accounts, of

particular significance for the purchase or sale of goods and services in addition to those taken on in the normal course of

business that would require specific information to be given for a better understanding of the Company's financial position.

Schedule 24 details the amount of company assets held by third parties for the various reasons indicated therein.

6) Income Statement

Production value

Revenues from sales and services: these amount to 2,740,323 thousand euros (at 31 December 2009: 2,895,617 thousand

euros). They basically include revenues pertaining to the year from licence fees and advertising. A breakdown into major

components is given in Schedule 26. As can be seen from the distribution of revenues by geographic area, they almost all

originate in Italy.

As regards revenues from licence fees, the mechanism used to determine the per-unit fee envisaged by the Consolidated

Broadcasting Law ("separate accounting"), aimed at guaranteeing the proportions between costs sustained by Rai, and certified

by an independent auditor, for the performance of its public service remit and resources from licence fees, highlights a

lack of the latter for the period from 2005 to 2009, totalling over 1.3 billion euros, of which more than 300 million euros

refers to 2009 alone. For 2010, the "separate accounting" figures will be available, as established, within four months of the

date on which the Shareholders' Meeting approves the financial statements.

Changes in inventories of work in progress, semi-finished and finished goods: these amount to 59 thousand euros (at

31 December 2009: 6 thousand euros). They are entirely attributable to the increase in the value of inventories associated

with the books publishing and periodicals business.

Internal cost capitalisations: the amount of 14,200 thousand euros (at 31 December 2009: 15,418 thousand euros) represents

internal costs associated with non-current assets, which were capitalised under the specific asset captions. Details are

shown in Schedule 27.

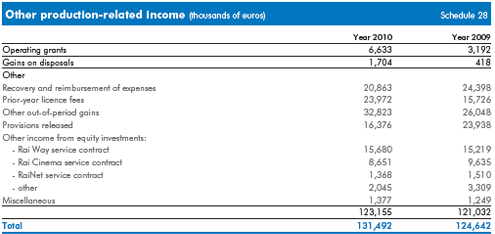

Other production-related income: this amounts to 131,492 thousand euros (at 31 December 2009: 124,642 thousand

euros), as detailed in Schedule 28.

Production costs

This caption comprises costs and losses related to ordinary activities, excluding financial operations. The costs shown here do

not include those relating to non-current tangible and intangible assets, which are recorded under the respective asset accounts.

Raw materials, supplies, consumables and merchandise: these total 22,703 thousand euros (at 31 December 2009:

23,054 thousand euros), which includes purchases of technical materials for inventory - excluding items used in the construction

of plant, which are allocated directly to non-current tangible assets - production materials (sets, costumes etc.) and miscellaneous

operating materials (fuel, office supplies, printed documents etc.), net of discounts and allowances, as shown in Schedule 29.

Services: these amount to 811,621 thousand euros (at 31 December 2009: 838,302 thousand euros) and comprise costs

for freelance workers and other external services, net of discounts and allowances, as shown in Schedule 30.

Among other things, they include emoluments, remuneration for special functions, attendance fees and reimbursement of

expenses paid to Directors for 2,186 thousand euros and to Statutory Auditors for 196 thousand euros. To provide a complete

picture of the situation, following the merger by incorporation of RaiSat SpA into Rai SpA, the caption discloses costs of 17

thousand euros for the directors of the incorporated company and of 32 thousand euros for statutory auditors.

They also include 188 thousand euros of annual fees for the statutory audit by independent auditors, 38 thousand euros for

other auditing services, and 15 thousand euros for other non-audit services.

Use of third-party assets: these amount to 827,564 thousand euros (at 31 December 2009: 910,058 thousand euros), and

express costs for rents, leases, usage rights and filming rights, as detailed in Schedule 31.

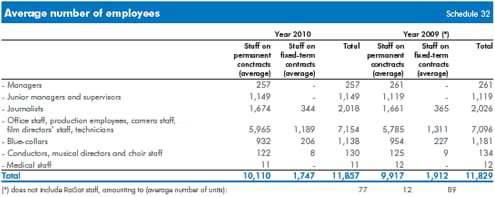

Personnel costs: employee-related costs amount to 911,045 thousand euros (at 31 December 2009: 903,548 thousand

euros), broken down as indicated in the income statement. The average number of employees on the payroll in 2010 was

11,857, including employees on fixed-term contracts, as detailed in Schedule 32.

Amortisation, depreciation and writedowns: these amount to 374,644 thousand euros (at 31 December 2009: 378,459

thousand euros). The breakdown is shown directly in the income statement. In detail, amortisation in relation to intangible assets

refers basically to industrial patents and intellectual property rights for 270,009 thousand euros (at 31 December 2009:

273,433 thousand euros), while Schedules 33 and 34 provide details of depreciation of tangible assets and writedowns in

relation to non-current assets. They include a writedown of capitalised programmes amounting to 28,986 thousand euros,

which was made to take account of the risk that certain programmes may not be transmitted or re-broadcast.

Changes in inventories of raw materials, supplies, consumables and merchandise: the amount of 241 thousand euros

(at 31 December 2009: minus 93 thousand euros) represents the increase in net inventories carried under current assets at

31 December 2010 with respect to the previous year.

Provisions for risks: these amount to 15,611 thousand euros (at 31 December 2009: 27,569 thousand euros) and indicate

allocations to provisions for risks. The most significant items are detailed in Schedule 16.

Other provisions: these amount to 515 thousand euros (at 31 December 2009: 1,740 thousand euros). The main items

are shown in Schedule 16.

Other operating costs: these amount to 82,903 thousand euros (at 31 December 2009: 97,046 thousand euros). Their

composition is shown directly in the income statement and further information is provided in Schedule 35.

Financial income and expense

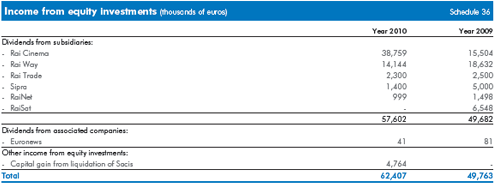

Income from equity investments: this amounts to 62,407 thousand euros (31 December 2009: 49,763 thousand euros),

and is represented by 57,643 thousand euros of dividends distributed in 2010 by investee companies, and 4,764 thousand

euros of capital deriving from the completion of the liquidation of Sacis SpA, as shown in Schedule 36.

Other financial income: this amounts to 4,605 thousand euros (at 31 December 2009: 5,412 thousand euros) broken

down as follows:

• from non-current receivables: booked for 11 thousand euros for interest income on cautionary deposits;

• from non-current securities other than equity investments: booked for 73 thousand euros and referring to interest earned;

•financial income other than the above: this amounts to 4,521 thousand euros and mainly relates to interest on current

receivables as shown directly in the income statement and detailed even further in Schedule 37.

Interest and other financial expenses: these amount to 5,072 thousand euros (at 31 December 2009: 4,914 thousand

euros). They relate to interest expense, commission expense for financial services received and other charges for financial

operations, as shown directly in the income statement and in further detail in Schedule 38.

Foreign exchange gains and losses: these show a gain of 2,401 thousand euros (at 31 December 2009: 806 thousand

euros), representing the balance of foreign exchange charges and premiums on foreign currency hedge transactions as well

as the effect of translating the value of payables and receivables in foreign currencies at year-end exchange rates or the rate

in force at the time of the hedge in the case of exchange risk hedges, as detailed further in Schedule 39.

Value adjustments to financial assets

Revaluations: these amount to 465 thousand euros (at 31 December 2009: 199 thousand euros). They reflect the recovery

of losses incurred by subsidiaries in previous years.

Writedowns: these total 3,062 thousand euros (at 31 December 2009: 2,133 thousand euros). They comprise writedowns

of non-current financial assets following losses incurred for the year.

Exceptional income and expense

The caption is comprised of charges of 45,470 thousand euros and income of 415 thousand euros and is analysed in Schedule 40.

Current income taxes for the year, and deferred tax assets and liabilities

These amount to 15,134 thousand euros. They are made up as follows:

The following table shows the origin and effects of deferred tax items during the year.

The following table presents the estimated reconciliation between the statutory result for the year and the taxable amount for

IRES and IRAP purposes.

On the taxable amount for IRAP, current taxes of 25,600 thousand euros have been calculated.

7) Result for the year

The year closed with a loss of 128,467,320.38 euros.

8) Other information

As regards disclosures on related parties, no significant transactions took place outside the normal market conditions. For

details on relations with Group companies, see the Report on Operations.

By rulings no. 2379/2010 of 28 October 2010 (filed on 9 December 2010) and 326/2011 of 15/18 November 2010 (filed

on 23 February 2011), the Court of Auditors - Jurisdictional Section for the Lazio Region - ordered payment to Rai for state

tax damages by certain parties including executives and members of the Board of Director of Rai. Despite these rulings being

immediately enforceable, subject to suspension following appeal, uncertainties exist in relation to possible subsequent developments

in court. Owing to this the conditions no longer obtain for recording an account receivable.

For important events occurring after the closing date, see the Report on Operations.

|

|